The US crude, also known as West Texas Intermediate(WTI), traded for below $0 following the impact of the coronavirus on the global oil market.

This is however the first time in the history of US crude trading , that WTI is trading in a negative territory.

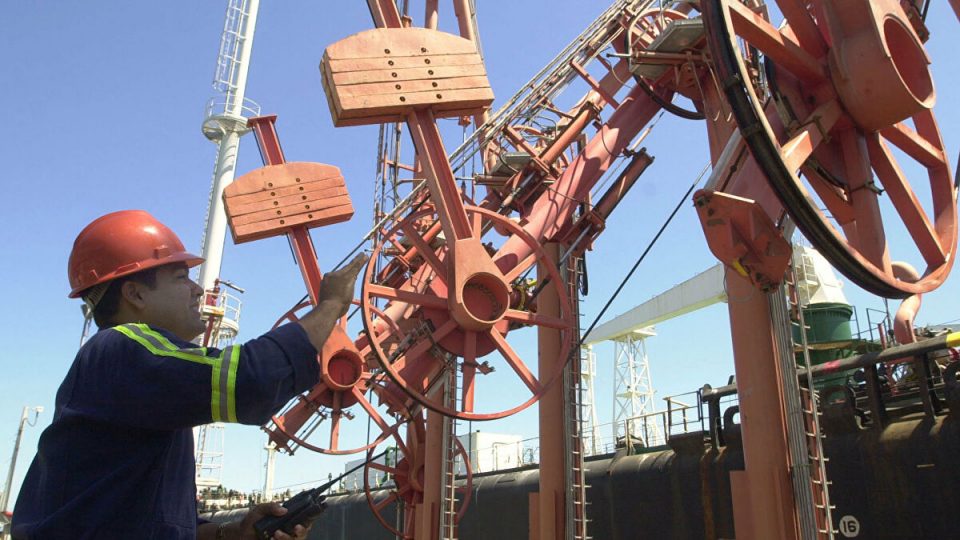

An oil expert working with the Abu Dhabi -based oil service company, Baker Hughes, Prince Ifeanyichukwu, who spoke to THEWHISTLER on Monday explained why the prices plunged that low.

He said. ” It’s the May WTI contract at Cushing that is trading at those prices as the oil there is already in storage.”

He further explained that the owners of the oil had their rental contracts until May and they could not prolong them because someone else took the space(Cushing).

He added that because they had their physical oil already hedged elsewhere “they needed to dump a ton of physical delivery on someone in May and don’t care what price it went for.”

“Quickest way to find an offtaker for May in Cushing is to look for someone who already had the storage capacity rented from May and enter into a WTI delivery contract.”

He added, ”Because storage is so sparse, the buyer is just gauging since they are the only one with the storage locked-in.

“Seller doesn’t care how much the buyer gauges because, again, they are already hedged.”

He however said WTI contracts didn’t have a negative price provision adding that adjustments were made on Monday morning “as people saw the situation coming.”