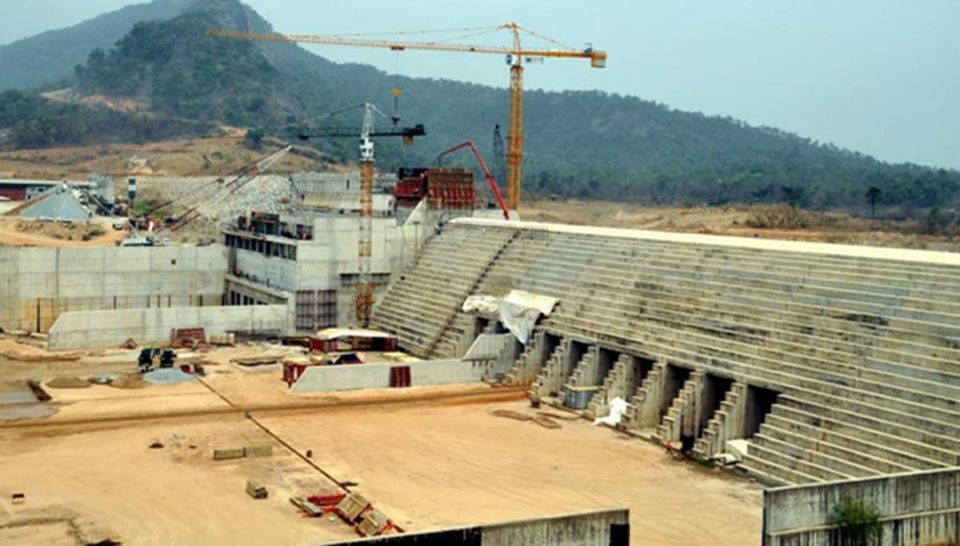

The Federal Government has said that it has so far spent about $5.8 billion on the 40-year-old Mambilla Hydroelectric Power project. The Mambilla Hydroelectric Power Station, is a 3,050 MW hydroelectric power project under development in Nigeria. When completed, it is expected to be the largest power-generating installation in the country, and one of the largest hydroelectric power stations in Africa.

Billed to commence operation in 2030, Mambilla will be Nigeria’s biggest power plant, producing approximately 4.7 billion KWh of electricity a year.

“The project is estimated to cost $5.8 billion and will generate up to 50,000 local jobs during the construction phase” a document obtained by Daily Sun shows.

Earlier, the Chairman, House Committee on Power, Magaji Da’u Aliyu, said the 40-year-old Mambilla Hydro Power, which has gulped billions of naira only existed on papers. He said that there was nothing on ground to show the project commenced before the coming of Muhammadu Buhari administration.

His conclusion came shortly after a Right of Way report from the Director, Renewable Energy and Rural Power Access, Faruk Yusuf Yabo that land for the project has just been acquired.

Assessing alternative funding for infrastructure amid fiscal constraints

The Nigerian government, like other developing countries, continues to face significant challenges in implementing programmes to build basic infrastructure through traditional funding sources like public expenditure and development finance aids.

These sources of financing have been found to be inadequate, as evidenced in Nigeria’s infrastructure gap. The country needs an estimated $100 billion or N36 trillion annually to address its infrastructural shortfall, according to The Minister of Finance, Zainab Ahmed.

Indeed, infrastructure development is very important for a country’s sustained economic growth and competitiveness. Well-developed infrastructure has the potential to increase productivity, which leads to poverty and unemployment reduction, facilitates trade, and promotes innovation in an economy.

Unfortunately, Nigeria and many other sub-Saharan African countries have huge infrastructure deficits with attendant low economic development.

This is measured through levels of physical capital of roads, public education, electricity production, health infrastructure, and access to treated water.

Given the need to bridge the infrastructure deficit and financing challenges, Nigeria needs to leverage alternative sources of funding such as the capital market.

Chief Executive Officer, Chapel Hill Denham, and Chair, Steering Committee, FMDQ Debt Capital Market Development Project, noted that the government budget, which is essentially about $26 billion, it is only seven and a half per cent that is going into critical infrastructure, which is somewhere around $2 billion annually.

“Nigeria’s annual infrastructure needs today is about $35 to $40 billion, and what it means is that the government’s wallet, no matter how you stretch, is completely inadequate. There is no magic that can change the figure. Government’s tax space in a short term or any other source of revenue in a short term cannot make any change.

“Nigeria like other parts of the world must wake up to the reality that it is all about private capital, and that without private capital you cannot really get the necessary infrastructure spending needed for substantial for economic growth.”

According to him, Nigeria represents an incredible opportunity, not only in physical and economic infrastructure but also in the areas of social infrastructure.

He insisted that “Nigeria has a big problem, and what is that big problem? When you put together all of the efforts and all of the dollars that go into infrastructure in Nigeria today, we are literally only sweeping the surface.

“The rest of the world has already known that there is not really so much that the development finance institutions (DFIs), and other initiatives can do on their own. The only way to achieve this is by utilizing the capital market and specifically through the debt capital market.”

He added: “Today, institutional fund managers globally, have $140 trillion of capital and listed infrastructure. There is also an increasing commitment to institutional capital. Private capital is pivotal to infrastructure financing through bonds and funds because they represent a sustainable funding source.”