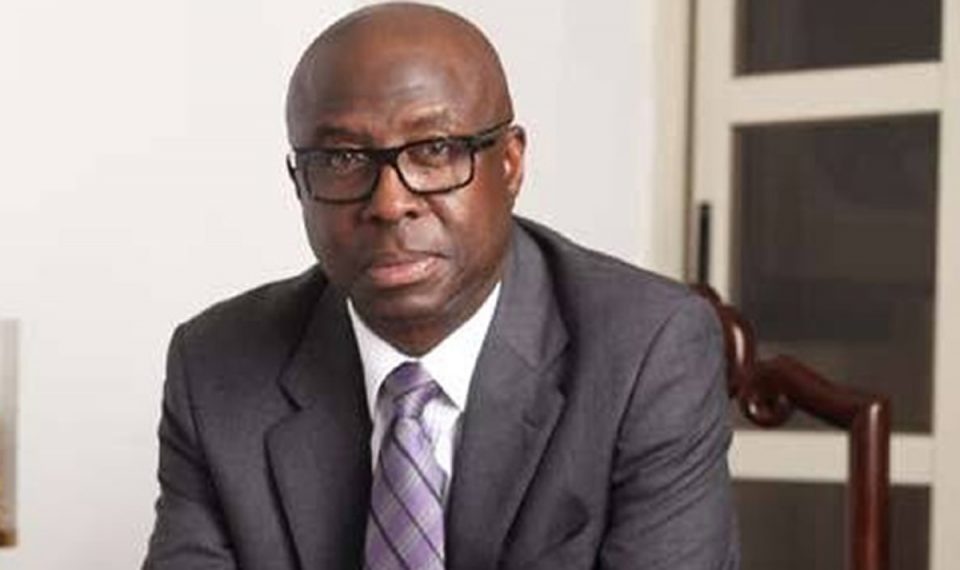

The Minister of Industry, Trade and Investment, Mr. Niyi Adebayo, yesterday said the Bank of Industry (BoI) has finalised plans to deploy a $1billion syndicated-term loan to support the Micro Small and Medium Scale Enterprises (MSMEs) sector.

He said the move was part of the federal government’s efforts towards economic recovery and sustainable growth, working with international partners to boost the sector.

Adebayo, at the Quantum Mechanics Limited MSME survival fund capacity building programme in Abuja added that the federal government is discussing with Dunn & Bradstreet to establish an SME risk rating institution – the SME Rating Agency of Nigeria (SMERAN), to provide an empirical basis for analysing the eligibility of SMEs to access credit.

He stated that the initiative will enhance the capacity of the bank to support small businesses across key sectors of the economy through the provision of affordable loans of medium to long-term tenor with moratorium benefits.

He said the survival fund could save at least 1.3 million jobs while strengthening the growth potential of beneficiary businesses. He added that the successful implementation of the scheme has so far contributed to pulling the country out of the COVID-19-induced recession.

The minister said the National MSMEs Clinics had also offered support for the growth of MSMEs through the provision of critical infrastructure, with 26 such clinics having impressive results.

He said the Nigerian Export Promotion Council (NEPC) had launched the Export Expansion Facility (EEF) under the National Economic Sustainability Plan (NESP) to support the resilience of new and existing MSMEs to respond to the shocks of the pandemic to retain and create more jobs, especially youth and women businesses through the Youth Export Development Programme (YEDP) and Promoting Women Inclusiveness in Non-Oil Export.

Adebayo, in a statement by his media aide, Mr. Ifedayo Sayo, said: “I will like to reiterate that our ministry fully supports MSMEs, as demonstrated by our MSME survival fund initiative, which was launched in the wake of the COVID-19 pandemic by the federal government as part of the Nigerian Economic Sustainability Plan (NESP), aimed at protecting MSME businesses from the shocks of the pandemic.” According to him, the Payroll Support Scheme meant to support MSMEs in meeting their payroll obligations and safeguard jobs by paying up to N50,000 to a maximum of 10 employees in each MSME for three months is part of the federal government’s efforts to cushion the effect of the pandemic on MSMEs.

He, however, added that the policy has been reviewed to N30,000 per