The manufacturing sector witnessed a sluggish growth in the first quarter of 2019 due to electioneering activities, in spite of the sustained growth of the Purchasing Managers’ Index (PMI) for 26 consecutive months.

The first quarter Gross Domestic Product (GDP) report released by the National Bureau of Statistics (NBS) showed that the manufacturing sector grew by 0.81 per cent as against 2.35 per cent recorded in fourth quarter of 2018.

The manufacturing sector standing at 0.81 per cent during the first quarter of 2019 fell by 2.59 per cent compared with 3.4 per cent recorded in corresponding period 2018 and by 1.54 per cent when compared with 2.35 per cent of the fourth quarter of 2018.

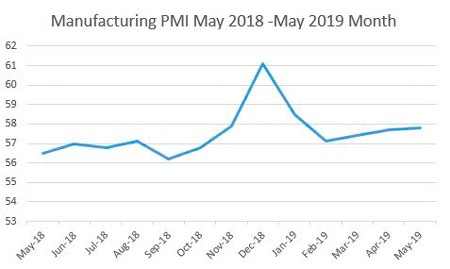

However, this contrast with the consistent rise in PMI during the review period.

According to the PMI report of the Central Bank of Nigeria (CBN) for May, manufacturing PMI rose to 57.8 index points from 57.7 index points recorded in April.

The PMI is an indicator of the economic wellbeing of the manufacturing sector and is based on five major indicators – new orders, inventory levels, production, supplier deliveries and the employment environment.

The production Level index of the manufacturing sector grew at 59.1 points from 58.8 points recorded in April and supplier delivery time index stood at 58.4 points as against 58.1 points recorded in April.

Employment Level index rose to 57.3 points from 57.0 points, however, decline were seen for total new orders and raw materials inventory which slowed to 56.9 points from 57.2 points and 56.8 point from 57.5 recorded in April respectively.

Mr Muda Yusuf, Director-General of the Lagos Chamber of Commerce and Industry (LCCI), said the performance of the GDP in the first quarter of 2019 was not surprising being an electioneering period with little economic activities.

He noted that continuous improvement in the business environment and strong institutions would ensure seamless economic activities irrespective of the political environment.

Yusuf said there was need to address issues of operating, production and transportation cost for the PMI growth to reflect and translate to economic growth.

He expressed optimism that growth in the manufacturing sector would increase based on the expected improvement in consumer spending arising from the implementation of the new minimum wage and the budget.

Mr Hamma Kwajaffa, Director-General, Nigerian Textile Manufacturers Association (NTMA), said despite the high PMI, the rising level of unsold inventory was a concern that had impinged on the sector’s growth.

Kwajaffa said many manufacturers were facing the challenges of unsold goods arising from low purchasing power of consumers and the harsh economic situation.

He noted that the issue reflected in the decline recorded in the PMI measurement for new orders and raw materials inventory.

Kwajaffa urged government to address the challenges of inadequate power supply which constituted about 35 per cent of production cost.

Also, an economist, Mr Akin Akinbiyo, said the PMI index continued to reflect an expanding economy, adding that without strong policy impetus economic consolidation might be threatened.

He said improved fiscal performance complemented with favourable monetary policy and business environment would ensure the PMI expansion resulted to GDP growth.

Worried by the dismal performance of the manufacturing sector in the first quarter of 2019, the Manufacturers Association of Nigeria (MAN) urged the Federal Government to increase efforts to boost the performance of the manufacturing sector.

MAN urged the government to improve power supply and general upgrade of the nation’s infrastructure.

It urged the government to make foreign exchange easily accessible for purchase of manufacturing inputs that were not locally available and convergence of the existing foreign exchange windows.

The association seeks the establishment of

better monetary policy management to reduce the current high inflation and permanent solution to the gridlock around the Lagos ports.