Securities and Exchange Commission (SEC) tower. Photo/nairametrics

The Securities and Exchange Commission (SEC) has flayed the proliferation of Ponzi schemes, describing them as a threat to investors’ protection, functioning of a fair and orderly financial market and the development of the economy.

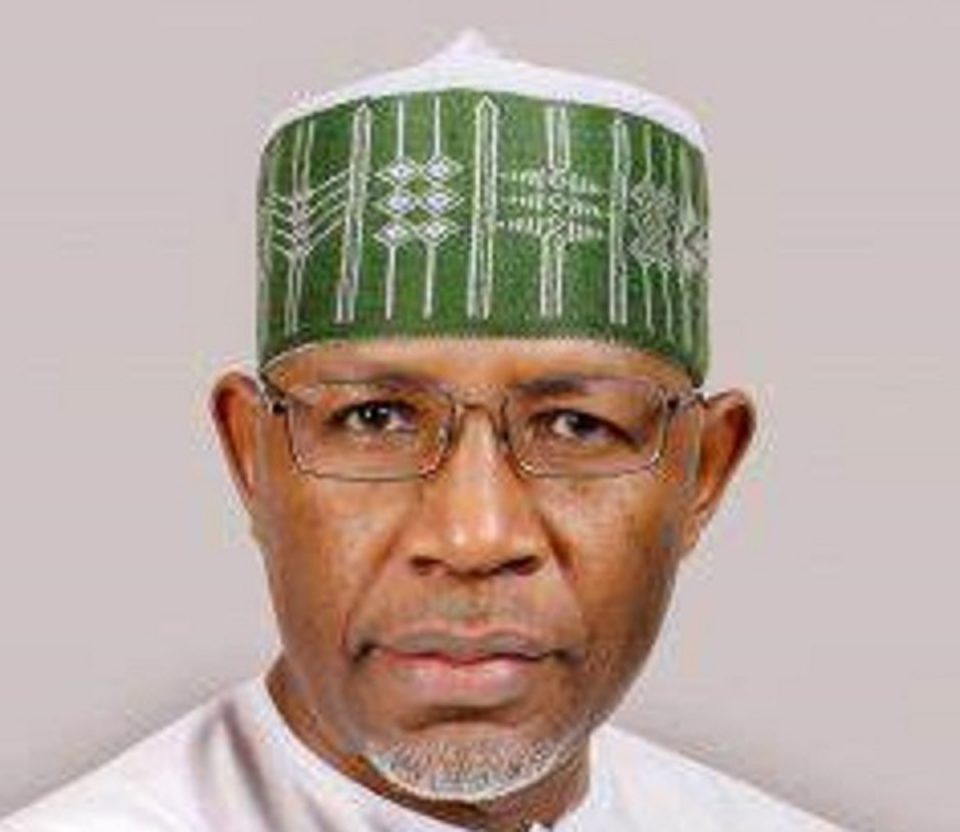

Director-General of the SEC, Lamido Yuguda stated this during the opening of a two-day webinar organised by the Attorney General Alliance-Africa in collaboration with the commission on Tuesday.

Yuguda said the devastating impact of the Covid-19 pandemic on the economy, the low-interest-rate environment coupled with the increasing use of online services have spurred the resurgence of illegal investment outfits.

He urged Nigerians to stay away from fake financial experts who would promise to double their money within a short time.

He said Ponzi scheme operators had capitalised on the harsh economic climate to offer unrealistic returns on investments to unsuspecting investors. These illegal schemes have also been able to solicit new investors and expand their operations through the increase in the use of online services, he said.

Yuguda, however, stated that SEC has a statutory duty to promote investor education and capacity building in market operations, saying that the programme is organised in furtherance of the mandate.

“This capacity-building programme will allow participants to learn contemporary and innovative ways of combating and curbing the menace of Ponzi schemes in Nigeria.

“I believe the knowledge gathered from this programme will provide participants new ways of approaching, assessing and tackling the growing problem of Ponzi Schemes,” he said.

He described the theme of the programme as apt, and its organisation timely given the contemporary challenges confronting Nigeria’s financial sector and its regulators.

The pervasiveness of Ponzi schemes undermines regulatory efforts in developing the capital market, and also negatively impacting investors’ confidence.

“Ponzi schemes operate with unsustainable models that ultimately lead to huge losses for investors. Following the collapse of the MMM Ponzi scheme, the Nigerian Deposit Insurance Corporation (NDIC) had estimated that over three million Nigerians lost about N18 billion. Several other illegal investment schemes have cost Nigerians their assets and life savings,” he stated.

The SEC boss said the Commission’s efforts in addressing Ponzi scheme challenges are aimed at protecting investors and preserving market integrity, stating that the Nigerian capital market should be a safe destination for investors.

He assured that the SEC would continue to apply innovative measures to combat the activities of Ponzi schemes while seeking the cooperation of relevant stakeholders.