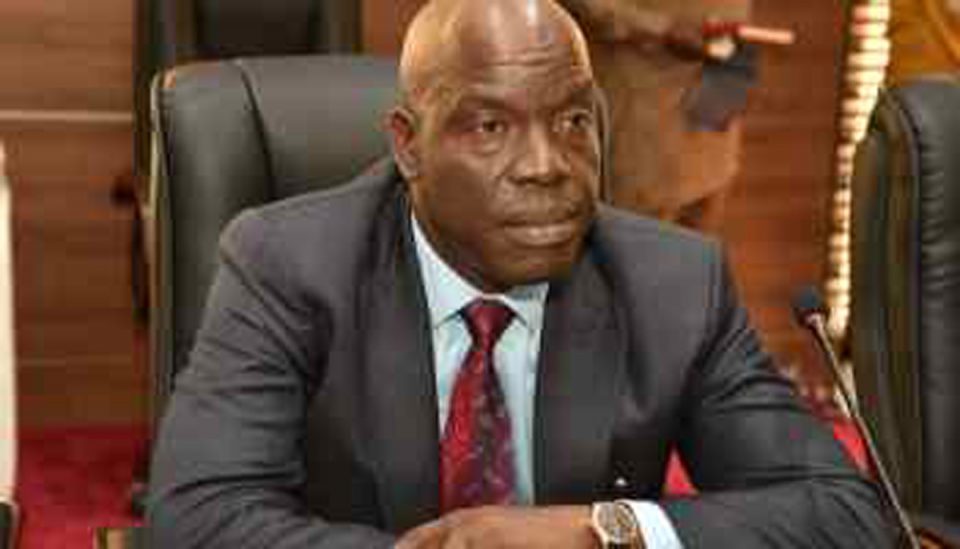

The Chief Executive Officer of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Mr. Gbenga Komolafe, has said Nigeria lost about N434 billion (about $1 billion) to oil theft between January and March this year.

The huge amount lost to oil theft was disclosed same day the Minister of State, Petroleum Resources, Mr. Timipre Sylva, said international oil companies (IOCs) are leaving Nigeria because the environment was becoming too volatile for their operations.

Also, Africa’s richest man and President of the Dangote Group, Alhaji Aliko Dagote has advised the federal government to introduce a single-digit tax regime to encourage investments in the downstream and midstream sectors of the Nigerian oil and gas industry.

Komolafe was speaking at the Iwereland Petroleum Communities Summit on the implementation of the Host Communities’ Development Trust in oil producing Itsekiri communities under the Petroleum Industry Act (PIA) 2021 hosted by the Olu of Warri, Ogiame Atuwatse III.

The upstream regulator disclosed that only about 1.35 million barrels or 71 per cent of the 1.9 million barrels that Nigeria produces, all things being equal, gets to the crude oil export terminals due to massive theft and pipeline vandalism.

Stressing that the challenge was hindering Nigeria from meeting her crude oil output capacity, Komolafe said out of about 141 million barrels of crude oil the country produced during the period, about nine million barrels were lost to crude oil theft.

Given the prevailing price of an average of about $116 per barrel at the international crude oil market, and an official exchange rate of N415/$, the loss sums up to about N434 billion.

“While the commission is prioritising efforts towards increasing oil and gas production and ensuring maximum economic recovery in Nigeria through the optimisation of oil and gas value chain, there have been challenges limiting the country from making the much-desired progress,” Komolafe lamented.

Nigeria has under-produced for months now and it had been unable to meet the Organisation of Petroleum Exporting Countries (OPEC) quota. It also means that the country has not able to reap the full benefits of the rising oil prices.

The NUPRC boss lamented that the loss to oil theft could have been available for development of social projects like hospitals, schools, roads, provision of electricity and potable water, to improve the quality of life of the people.

Beyond the loss in revenue, he said the sabotage of oil and gas facilities had resulted in additional remediation cost to the government as well as environmental degradation from oil spills.

In addition, he listed soil and water pollution, threat to human life, source of livelihood, wildlife and marine life (fishes) and crops as some of the impacts of the increasing theft of Nigeria’s oil.

These losses, he said, underscored the need for the government to optimise oil and gas resources development and production through the passage to law of the Petroleum Industry Bill (PIB) after more than 20 years.

Komolafe said the enactment of the PIA opened new opportunities in the country’s oil and gas industry, with extensive provisions to foster sustainable prosperity of host communities and enhance peaceful and harmonious co-existence of oil companies with their host communities.

Section 235 of the Act, he said, specifically provides for the incorporation of Host Communities Development Trust (HCDT) by the Settlors (the oil and gas companies) for the benefit of the host communities.

He noted that although the responsibility to set up HCDT and appoint the Board of Trustees was vested in the companies in consultation with the host communities, Section 247 of the Act requires the Board of Trustees (BoT) to set up a management committee to handle the general administration of the fund.

In addition, he noted that the management committee was required to in turn, set up an advisory committee to advise on activities as well as monitor and report progress of projects in the community to the body.

“The law provides that the host communities should be represented in the Board of Trustees, Management Committee and Advisory Committee, while Section 235(6) empowers the NUPRC to make regulations on the administration, guide and safeguard the utilisation of the trust fund and have the oversight responsibility for ensuring that the projects proposed by the Board of Trustees are implemented,” he noted.

According to him, the commission has concluded arrangements to ensure the regulations guiding the implementation of the host community development fund under the PIA 2021 comes into effect before the end of June 2022.

Komolafe said this would signal the commencement of a seamless implementation of the host community development fund for the benefit of oil producing communities.

He pledged that the commission would focus on working with the host communities and other stakeholders to ensure investments in the oil and gas sector are adequately protected, while ensuring the safety and sustainability of the environment.

The chief executive said the commission was committed to ensuring that the three per cent deduction required from the Settlor’s annual operating expenditure (OPEX) was not short-changed and that funds were remitted in good time.

He added: “We shall also ensure that projects and programmes proposed by the HCDT are implemented as well as ensure fair and adequate compensation for damaged environment and apply sanctions where necessary on defaulters.”

Sylva: Why International Oil Companies Are Leaving Nigeria

In a related development, Sylva has said IOCs were leaving Nigeria because the environment was becoming too volatile for their operations.

In an interview with The Energy Year, a market intelligence organisation, Sylva stated that Nigeria’s situation had become, “precarious” because of the multitude of challenges besetting the oil sector.

The minister noted that while Nigeria was tackling the challenges, the damage being done by vandals was eroding investors’ confidence in the oil and gas industry.

“Our biggest problem is the insecurity of our pipelines. There is a lot of pollution due to oil theft and pipeline vandalism, which has placed us in a precarious situation. It is one of the biggest reasons why IOCs leave Nigeria.

“They (IOCs) feel that our industry is becoming too volatile and a significant polluter. The criminals who rupture our pipelines to set up illegal refineries which are not regulated are seriously damaging our environment.

“It is our duty to ensure that we can tackle this issue, which is mainly a question of law and order rather than production. Once solved, all the production that has been lost will get to our tanks, while restoring investors’ confidence in Nigeria,” he said.

According to the minister, while the goal was to restore Nigeria as the leading crude oil producer in Africa, if the country could tackle security and technical issues, it should be able to ramp up production to 2.6 million bpd, and in the long run, boost it to three million bpd.

Describing fuel subsidies as, “the biggest impediment to the growth of the downstream sector,” Sylva stated that nobody wants to invest in an industry where they cannot even recover their cost of production.

On the projections for growth, Sylva noted that the Dangote Refinery would come on stream by the end of the year plus a significant number of modular refineries which are also coming on line as well as the rehabilitations of the refineries which are expected to boost local refining.

“Once the subsidies are removed and these projects are operational, a golden period for the Nigerian downstream sector will begin,” he maintained.

He reiterated that Nigeria has not been able to meet its production quota because it was finding it difficult to restart oil wells it shut down in the heat of the Covid-19 pandemic.

“During the pandemic, OPEC asked us to bring down production because oil prices were at a historical low. Unfortunately, Nigerian reservoirs react in a particular way, and when you want to shut down 100,000 bpd, you end up shutting down 300,000 bpd to achieve the desired 100,000 bpd. As a consequence, the drop has been drastic,” he explained.

He added that as a country, Nigeria was not taking full advantage of the high oil prices because production is not meeting expectations.

“We are now in a very disturbing situation where we cannot meet our OPEC quota, but we are working assiduously on this by looking at all the relevant issues. For example, we are tackling the problem of crude oil theft, which has seriously affected our production,” he said.

On local content, he pointed out that Nigeria has made significant progress in 10 years, growing local participation in the oil and gas sector from 3 per cent to 35 per cent, saying that a target of 70 per cent has been set for the near future.

He added that the concluded 2020 marginal field bid round will bring local companies into the production space by allowing them to learn how to operate with smaller fields and prepare them to take over any assets divested by IOCs.

Dangote Calls for Single-digit Tax Regime to Encourage Investments in Petroleum Sector

Meanwhile, Dangote has advised the federal government to introduce a single-digit tax regime to encourage investments in the downstream and midstream sectors of the Nigerian oil and gas industry.

The promoter of the 650,000 barrels per day Dangote Refinery and Petrochemical Plant, also emphasised the need for the government to invest more on quality infrastructure to reduce importation of refinery equipment that would ordinarily be sourced in Nigeria.

Dangote made the call in Lagos while speaking at the just-ended Nigerian Content Midstream and Downstream Summit organiser by the Nigerian Content Development and Monitoring Board (NCDMB), with the theme: “Maximising Potentials in the Midstream and Downstream Oil and Gas Sector – A Local Content Perspective.”

The Director, Corporate Communications, Dangote Group, Mr. Tony Chiejina, in a statement stated that the President of Dangote Group was represented at the event by the Technical Consultant, Dangote Industries Limited, Mr. Babajide Soyode.

Dangote noted that the development of specific, sustainable equipment manufacturing and services should be the focus of the NCDMB and the federal government.

“Funding of a project should be to ensure that substantial part of the product plant must be of Nigerian origin; the same applies to goods and services.

“Government should ensure a single digit tax regime to encourage investment in the downstream sector,” Dangote said.

He, however, stated that the coming on stream of his refinery would expose Nigeria’s midstream and downstream sectors to the international markets.

He maintained that the refinery currently under constructed in Ibeju-Lekki, Lagos, would guarantee availability of high quality environmentally compliant products in Nigeria, regional markets in West Africa, Southern Africa and inter-continental markets.

Dangote said the refinery would promote competition of local refining in Africa by encouraging existing large refineries to upscale, which would result in surplus products for exports.

“Dangote Petroleum Refinery will guarantee adequate fuels production for domestic consumption and availability of excess products for export which will help to stabilise our domestic currency.

“It will lead to upgrading and expansion of Nigerian National Petroleum Company Limited’s refineries and promotion of prospects of Nigeria’s transformation to a regional refining hub,” Dangote stated.

Brent Crude Oil Hits $120 Per Barrel

Oil prices climbed above $120 a barrel yesterday, hitting their highest in more than two months as traders priced in expectations that the European Union would eventually reach an agreement to ban Russian oil imports.

Brent crude futures contract for July, which would expire today, was up $1.35, or 1.1 per cent, at $120.78 a barrel. The August Brent contract , which was more active, rose $1.27 or 1.1 per cent to $116.81 a barrel.

Also, United States West Texas Intermediate (WTI) crude futures jumped $1.11 or one per cent to $116.18 a barrel, extending solid gains made last week.

The EU is meeting to discuss a sixth package of sanctions against Russia for its invasion of Ukraine, which Moscow calls a “special military operation”.

“Europe has been haggling about this for the better part of a month, but increasingly the market is pricing (additional sanctions) in as a risk,” said Daniel Ghali, senior commodity strategist at TD Securities in Toronto.