The National Bureau of Statistics (NBS), the total Micro, Small and Medium Enterprises (MSMEs) and Micro enterprises grew by 12.1 per cent in 2017 compared to 2013.

It said this in its “MSMEs National Survey 2017 Report” released on its website on Thursday in Abuja.

According to the report, micro enterprises, being 99 per cent of MSMEs drives the trend for the entire category.

The survey was carried out to establish a credible and reliable database for the MSMEs sub-sector in Nigeria and their contribution to jobs and wealth creation.

The survey was conducted in all 36 states of the federation, including the Federal Capital Territory (FCT), while both the urban and rural enumeration areas (EAs) were covered.

The report also said that small enterprises, grew by 4.6 per cent from 2013, but that the number of medium-sized enterprises decreased significantly from 4,670 in 2013 to 1,793 in 2017, indicating a 61 per cent drop.

According to it, MSMEs generated 59,647,954 jobs as at December 2017, while five per cent or 2,889,715 of those jobs were created by SMEs.

The report also said that males accounted for 57 per cent of jobs created by SMEs, compared to 43 per cent for women, adding that more males were employed in both Micro and Small/Medium enterprises.

It indicated that there was greater disparity amongst employees and within SMEs.

“Notably, the education sector is the only sector with gender parity in jobs (53 per cent women), while manufacturing employs three times more males than females.”

The report said that sectors with the highest number of employment were education with 1,065,755, human health and social works 612,622 and manufacturing which had 607,498.

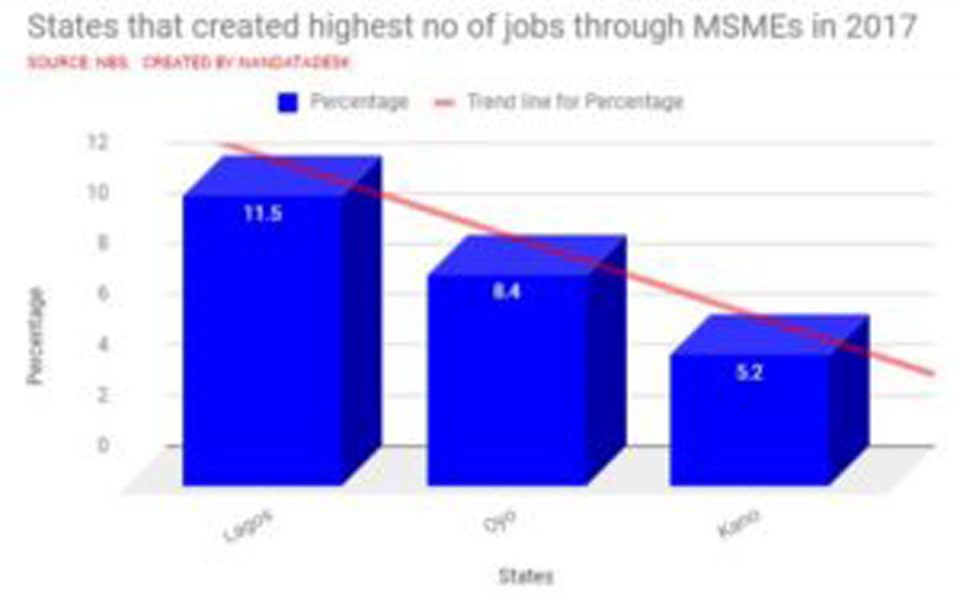

It also gave the statistics of states with highest number of jobs created to be Lagos with 11.5 per cent, Oyo 8.4 per cent and Kano with 5.2 per cent.

States that created highest no of jobs through MSMEs in 2017

For source of capital for these businesses, it observed that personal savings was the most common source of capital, while loans, family and Cooperative/Esusu made up some other sources.

“For SMEs operators who had access to bank credit, commercial banks were the main source of these funds (91.9 per cent), while 4.7 per cent accessed credit from Micro-Finance Institutions and one per cent from Development Institutions.

“SMEs in Oyo, Jigawa, Lagos, Kano, and the FCT reported having the most access to bank credit.”

According to the report, there is a widespread lack of capital and poor integration into the financial markets, which may be due to low business planning incidence and low formalisation.

It said that most enterprises were operating without legal and financial protection, adding that 75.6 per cent of micro enterprises had no business plan, while 65 per cent of SMEs were in the same category.

“This lack of planning in MSMEs contributes to high rate of failure and a reluctance from investors in providing capital,” it said.

It also said that 96.61 per cent of micro enterprises were uninsured and 63.9 per cent of SMEs were also uninsured, making MSMEs vulnerable to business shocks and lack of integration into financial markets increasing their risks.

The report stated that access to finance was top priority area for assistance for both SMEs and micro enterprises.

“For SMEs, the most pressing area for assistance is in power and water supply as well as tax rate reduction.”

The report observed that high fuel price, taxes and power supply were the top unfavourable policies for micro enterprises because it reflects a challenging operating environment for them.

Similarly, for SMEs, high electricity tariff, high taxes and high interest rates were regarded as top unfavourable policies as they reflect the challenges of formalisation.

In its recommendations, the report proposed a review of the system of classification of businesses, particularly from the MSMEs National Policy and targeted policy implementation for each classification to address strengths and challenges of each business type.

For re-classification, it said micro enterprises were the majority of businesses in Nigeria, however, the large sub-sector could still be further broken down based on pro-establishment behaviour such as registration and turnover.

It recommended the introduction of “one-man business”/freelancers whose main objective was self-sustenance.

It also recommended the introduction of additional criterion in classification such as employment, assets and formal registration.

For targeted policies by business type, it said that micro businesses were facing challenges related to day-to-day running costs such as fuel, electricity, working capital, while SMEs face a more complex set of challenges related to access to capital and industrial utilities.

It, however, said that policies aimed at both business types should not be generic or lumped together.