From August 2020, The Petroleum Products Pricing Regulatory Agency (PPPRA) has decided that it would no longer publish the guiding price of Premium Motor Spirit (PMS). PPPRA will however intervene where they find the pump prices are too high and unjustifiable. What this means is that all operators must be able to defend their prices – empirically, to avoid sanctions by the market or PPPRA.

Over the next few editions of our newsletter, MOMAN will share the internationally benchmarked methodology for appropriate analysis of costs and pricing of petroleum pricing at the pump.

This week we begin with Retail.

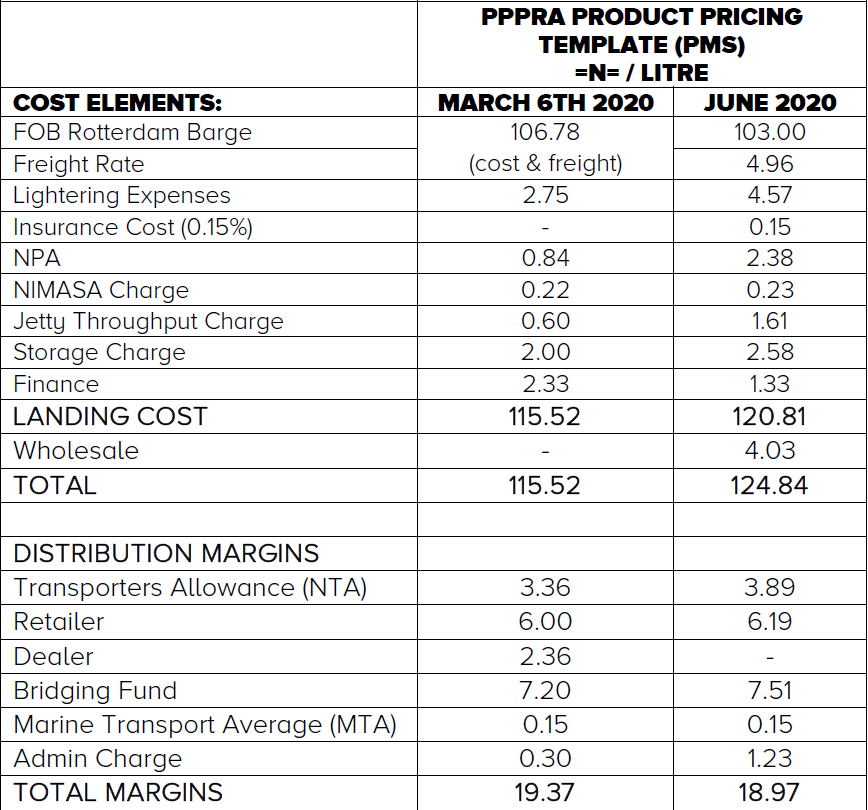

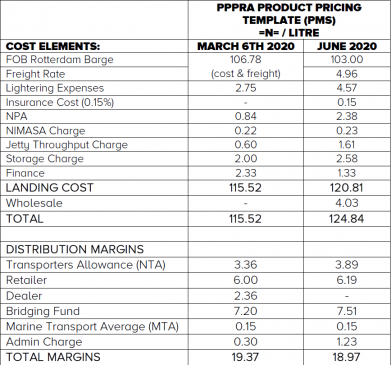

PPPRA’s PMS pricing is made up of 2 parts: Product / Importation Cost (Cost, Insurance & Freight) and Local Distribution Margins (cost of distribution and Return on Investment).

Details of the Cost Elements on the PPPRA Pricing Template:

- Product Cost: The cost of one metric tonne of petroleum product in US Dollars as quoted on Platts (S&P Global Platts). The reference spot market is FOB Rotterdam Barge

- Freight: This is the average cost of transporting (30kt) cargo from North West Europe (NWE) to West Africa (WAF)

- Lightering: Ship-to-Ship (STS)/Local Freight Charge is the cost incurred on the transhipment of imported petroleum products from the mother vessel into daughter vessel to allow for the onward movement of the vessel into the Jetty

- Insurance

- NPA: This is cargo dues (harbor handling charge) charged by the Nigeria Ports Authority for use of Port facilities

- NIMASA: Nigerian Maritime Administration and Safety Agency, Marine Pollution Prevention & Control, and Cabotage enforcement

- Jetty Throughput Charge: This is the tariff paid for the use of facilities at the Jetty by Marketers, to move products from the jetties to storage depots

- Storage Charge: Storage Margin is for depot operations covering storage charges and other services rendered by the depot owners

- Financing: It refers to stock finance (cost of fund) for the imported product. It includes cargo financing, based on 25% of Landing Cost

Details of the Distribution Margins on the PPPRA Pricing Template:

- Transporters Allowance (NTA): Contribution to/reimbursement from the fund to defray the cost of local transportation of petroleum products within the same zone (Local Delivery) based on a Transportation Differential Zone map

- Retailer: Allowable margin to retailers of petroleum products after considering the overhead cost and other running costs

- Wholesale: Allowable margin to importers of petroleum Products after considering the overhead cost and other running costs

- Bridging Fund: Contribution to/reimbursement from the fund to defray the cost of transportation of petroleum products from one zone to another zone (Bridging) based on a Transportation Differential Zone map

- Marine Transport Average (MTA): Marine Transport Allowance (Coastal) Bridging

- Admin Charge

The visual representation of the template is shown below:

The recent changes in the pricing template were targeted at trying to ensure prices were at a level where the federal government no longer needed to incur the additional burden of subsidizing petrol. This was expected to make the template more reflective of market conditions, alas it does not appear that this pricing template review has achieved its intended objective particularly due to the high cost and unavailability of foreign exchange.

In many countries, Oil Marketing Companies (OMCs) are responsible for overseeing the running of their fleet of filling stations. In the previous PPPRA pricing template, the Retailers were entitled to N6.00 retail margin (marketer’s margin) to cover overheads and N2.36 (dealer’s margin) for the operational cost for running each station, making a total of N8.36. This was the methodology as the capital expenditure, the working capital costs and the administrative costs in managing the stations were factored into the retail cost.

The PPPRA website now has a retail margin of only N6.19, a reduction (which will have to be recovered by Marketers) from the N8.36 which Retailers previously enjoyed. The PPPRA’s website also reveals a wholesale margin of N4.03 which it describes as the importers margin. This does not reflect what was agreed to by the Price Modulation Committee of the PPPRA. With marketers not currently importing petroleum products into Nigeria, this wholesale margin would certainly not apply to them.

For the viability of the downstream petroleum industry, retail and wholesale margins, as a matter of fact, all margins, need to sufficiently pay for the cost of investments – capital expenditure and operational costs across the value chain. The margins need to cover the full cost of retailing the petroleum product. The margins also need to be based on a transparent methodology, feeding into a pricing strategy of individual marketers and updated regularly.

Study of the petrol filling station

Nigeria currently has approximately 30,000 retail stations nationwide. Originally, the filling stations were owned and operated by International Oil Companies (IOCs). Over time, the number of stations has grown, with the majority now being built and owned by Nigerians – trying to make a decent living for themselves and their families.

The petrol supply chain is quite complex and very costly, often resulting in significant value losses along the supply chain. But how is this possible one may ask – what with the ‘margins’ that the downstream operators receive? The truth is the margins on the pricing template are not profit. The margins have never been and are still not sufficient to cover related costs, not to even speak of providing a decent return on investment.

In the Integrated Business Model (the MOMAN business model), marketers are represented throughout the supply chain. They import products, transport products (through hired or owned vessels), throughput the products (using owned or hired jetties), store product (in owned or hired tanks), transport products (in owned or hired trucks) and sell these products (through owned or rented stations). Independent dealers also buy products ex-depot from NPSC/PPMC depots, MOMAN/DAPPMAN depots as well as independent depots and transport to their stations for sale.

There are three different station management structures under the Integrated Business Model. We have the:

- Company Owned Company Operated (COCO): These are stations developed and operated directly by the respective oil company employees

- Company Owned Dealer Operated (CODO): These stations are developed by the company and contracted to an independent dealer who operates the station under the company’s brand

- Dealer Owned Dealer Operated (DODO): These are stations that are developed and operated by independent owners, but under an oil marketing company’s brand

Some operators in the downstream petroleum business have other business models. Some may own vessels, some may own depots, some may own marine jetties, some may own trucks and some may own filling stations, all under their own brand names. Some may even have a combination of any two or more links in the supply chain, for example, owning vessels and depots, or owning jetties and depots, thereby being represented throughout the supply chain.

With respect to importation of petroleum products, the operator would need to show that it leases or owns significant assets (usually depots) on Nigerian soil in order to obtain a license to import.

Running a filling station is a job that has very little downtime. It is a business that requires a huge capital outlay, large amounts of working capital and has low unit margins per liter. With all the challenges stated, we see that the Nigerian retailing business has been extremely resilient.

Capital Investments – CAPEX

Below is a representation of the 3 categories of stations (and their associated costs) as developed by MOMAN. Note that most of the equipment installed at the filling stations are imported and as at the time this was prepared, an exchange rate of N360 to $1 was used to compute the USD denominated costs.

The Mega Station

The cost of building this category of filling stations could range from N260m to as high as N3bn, depending on most especially the cost of land. The station has a minimum of 6 PMS pumps, 2 AGO pumps and 1 HHK pump.

The Standard Station

The cost of building this category of filling stations could range from N170m to as high as N1bn, depending on most especially the cost of land. The station has a minimum of 4 PMS pumps, 1 AGO pump and 1 HHK pump.

The Rural Station

The cost of building this category of filling stations could range from N102m to as high as N200m, depending on most especially the cost of land. The station has a minimum of 2 PMS pumps, 1 AGO pump and 1 HHK pump.

These are very conservative estimates but based on minimum regulatory standards. As we all know the cost of land in Nigeria varies based on location and has a significant impact on the capital investment of building a filling station. Furthermore, some mega stations have as many as 40 pumps – also at a significant cost.

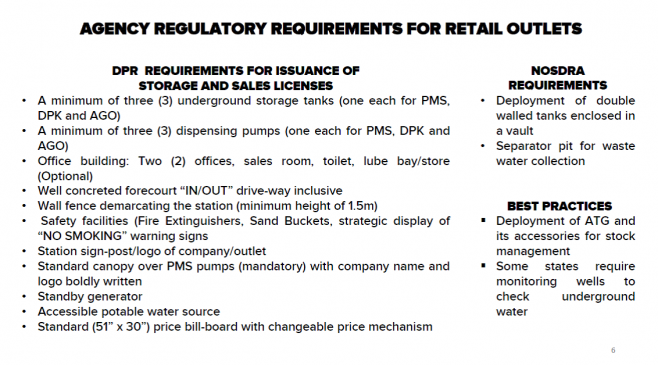

The investment at the filling station does not begin and end with just erecting a building and installing a few pumps. Filling stations are particularly hazardous workplaces and pose significant risks to lives and properties, as such several control measures MUST be put in place. In the past many stations were built using old regulatory standards. Now that regulatory standards have been upgraded, there is the need for stations to upgrade their facilities to meet these new standards which low margins have prevented station operators from meeting to date. For example, the adoption of modern technology (electronic pumps and automatic tank gauges – ATGs, linked to the company’s systems) helps to protect the customer and offer higher quality customer service. Citing another example, we see that the majority of stations in Nigeria were built using steel underground tanks which have a propensity to rust. International standards now adopted in Nigeria insist on double envelope High Density Poly Ethylene (HDPE) tanks to protect against pollution of underground soil and underground water. Adopting these measures and standards are non-negotiable as they are required to protect the life, health and safety of Nigerians; protect the environment and protect the quality of products. The world has moved towards adopting these standards in their downstream sector, Nigeria cannot afford to be left behind. Below is a list of some requisite regulatory requirements in building and running a filling station in Nigeria.

Operating Expenditure – OPEX

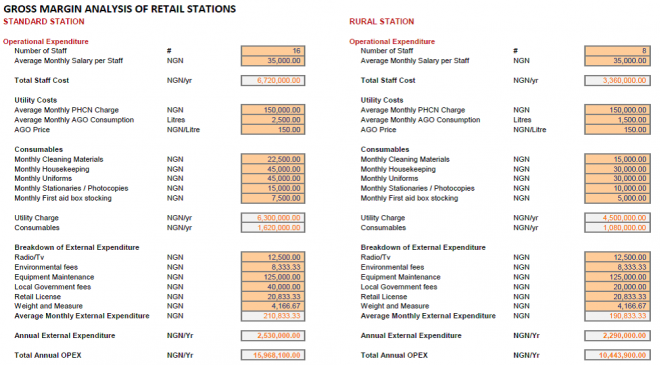

As seen in the chart below, a significant amount of funding is required for the day to day running of a filling station. Included in this OPEX are numerous charges from federal, state and local government agencies. The multiplicity of these charges from the agencies (as seen below) adds to the substantial amount of cost needed to run a filling station.

- DPR,

- NOSDRA,

- Federal & State Fire Service,

- Ministry of Trade and Investment (Weights & Measures),

- Local Development Council,

- State Environmental Protection Agencies,

- State Safety Commission,

- State Ministry of Finance,

- LIRS, etc.

The PPPRA has factored in a return on investment of only 6.5% in calculating the returns for the entrepreneur. This return of 6.5% is meant to compensate the entrepreneurs business risk, time, effort and opportunity cost of investing their capital elsewhere.

Conclusion

In business accounting, margins refer to the difference between the selling price and the costs for the goods or services on sale. The margins as shown on the template are not margins; they are costs.

From the rundown of the costs involved in building, running and maintaining a filling station, those wholesale and retailer margins on the template are not sufficient to cover all the costs involved in retailing petrol. For decades, the downstream operators have absorbed tremendous losses due to the pricing regime which has resulted in the closure of several depots and stations across the country and the gradual degradation of the sector.

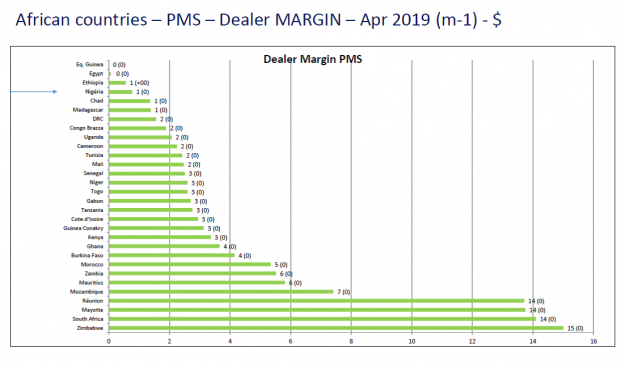

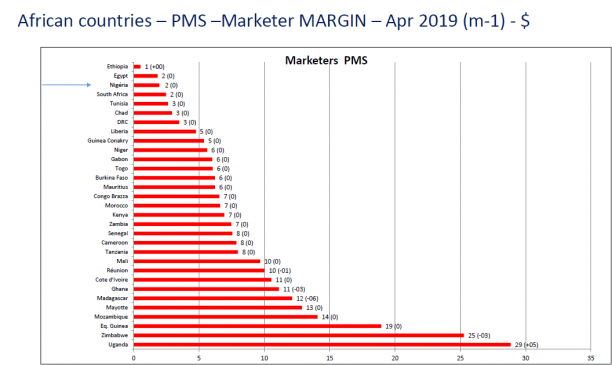

If we benchmark our margins with those of other African countries, it is very clear that the margins are not enough to maintain and upgrade the country’s deteriorating retail network. With these poor margins, it is no wonder why dealers also feel the need to cheat at the pumps and engage in sharp practices (which industry associations such as MOMAN cannot and do not condone). However, a self-sustaining industry requires a true reflection of all the costs.

The OMCs and station owners must develop a clear and transparent strategy when setting their pump prices. PPPRA would also need to take the points as presented above into consideration as they review the pump prices set by the OMCs and station owners.

Sources:

- South African Petroleum Industry Association (SAPIA)

- Petroleum Products Pricing Regulatory Agency (PPPRA)

- Major Oil Marketers Association of Nigeria (MOMAN)