Head of Economic Intelligence Research & Intelligence; MOMAN

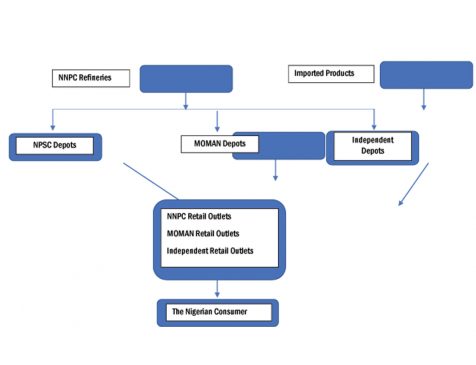

Petroleum products distribution is a complex chain of activities that include transportation and storage of petroleum products across the country. This process is done by a lot of players, including the depot owners. In discharging their duties, the depot owners’ need to store these products effectively and safely and still make a profit.

Ensuring the safe transfer and proper handling of petroleum products at oil depots is of utmost importance and can never be overemphasized. According to the Department of Petroleum Resources (DPR), Nigeria has over 120 functional depots nationwide, with a total storage capacity of over 20,800,000m3 which is used to store PMS, HHK, ATK, AGO, Base Oil, Bitumen and LPFO. Ownership of these depots is shared among NNPC, the major marketers and independent depot operators.

Over the last few years, the independent depot owners have faced numerous challenges, including battles with the Asset Management Company of Nigeria (AMCON), which has threatened the sustainability of their businesses and their means of livelihood. The Chairman of the Depot and Petroleum Marketers Association of Nigeria (DAPPMAN), Dame Winifred Akpani did mention in several articles that the control of the sector by the Nigerian National Petroleum Corporation (NNPC) has meant private depot operators have very little margins with which to re-invest. “A lot of them are in one problem or the other with banks and the Asset Management Corporation of Nigeria”. It is no secret that the low profit margin of depot owners has resulted in these operators not being able to improve on their infrastructure and operations. It is against this backdrop of challenges, that the situation with depot owners has become worsened and would likely not get better if left unaddressed.

As explained on the website of the Petroleum Products Pricing Regulatory Agency (PPPRA), storage charges are meant for depot operations covering storage charges and other services rendered by the depot owners. In other words, this charge is meant to cover all the overhead and operating costs of a typical depot. In the previous PPPRA pricing template, the storage charge as presented by PPPRA to cover all expenses related to running a depot was N2.00 per liter, down from the N3.00 per liter that the pricing template started with when the Agency was established. In July 2020, in an attempt to make the template more reflective of market conditions, the PPPRA increased this charge by N0.58 to N2.58 per liter. Like the retail margins, the tariffs for storage should be controlled by a formula, transparent, updated regularly and be non-discriminatory. These tariffs should also be set at a level to sufficiently cover the costs of the operators and include a reasonable rate of return on investment.

General features of a typical depot

There is a wide variety of depots and depot ownership structures in Nigeria.

- The capacity (size) of depots varies from owner to owner, state to state, etc.

- Depots can be independent or attached to large sites (refineries) and belong to small or large companies

- The location can be inland or coastal, with all types of transport modes involved, for example, ship, pipeline, road, rail

- The transport interface is a particularly important part of safe operations and poses unique challenges and risks

Study of the average depot facility

As stated above, the petrol supply chain is very complex. It is also quite costly, often resulting in significant losses along the value chain. In the past decade, a significant number of depots have closed shop due to insufficient margins to cover related costs.

Building and running a petroleum products storage and sales depot is a business that is highly capital intensive, in terms of both operational and working capital.

Capital investment (CAPEX) and Operating Expenses (OPEX)

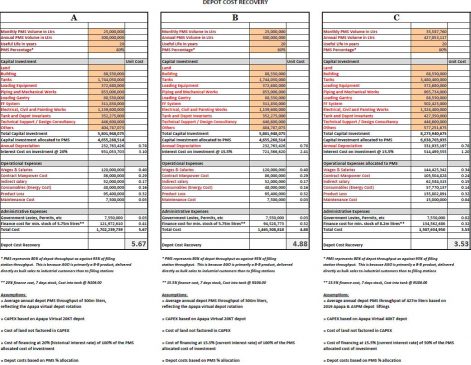

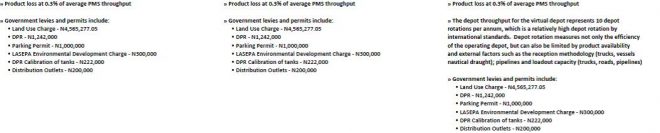

Below is a representation of 3 categories of depots (and their associated costs) as developed by MOMAN. Reasonable assumptions were made using 20KT and 40KT depot capacities.

Categories A and B are based on a theoretical 20KT depot with a PMS throughput of 300 million liters per annum, while category C mirrors the Apapa “virtual depot” – and is based on a 40KT depot (which is the average storage for all marketers depots in Apapa supplied through the NPSC and ASPM Apapa jetties) with a PMS throughput of 427 million liters per annum (which was the actual PMS throughput through these depots in 2019).

There are several benchmarks for measuring logistics efficiencies and the Apapa virtual depot is one of the most efficient. We have used an average tank rotation between 9 and 10 which is extremely efficient as the average in Nigeria is between 5 and 6. The tank rotation is a function of logistics realities consisting of jetty draught, reception methods (trucks, ship or pipelines), internal efficiencies, (number of loading arms, number and capacity of storage tanks, etc) and loadout methods (trucks or pipelines).

The tables above show that the minimum depot cost recovery is N3.53 and as high as N5.67. However, note that in all 3 categories, the price of land was not factored in. Land prices could range from N3bn to N5bn, depending on the location and this would significantly affect the cost recovery figures.

These estimates are very conservative and based on the application of minimum regulatory standards, international best practices and the application of technology to enhance safety at a typical depot. Some key standards that must be present at a depot include and are not limited to, vapor and liquid hydrocarbon detectors, provision of explosimeters, monitoring wells and ensuring all underground pipelines be catholically protected. All these standards are key for environmental monitoring and safety and are used to prevent pollution and check the degradation of underground soil. All these requirements come at a significant cost.

Conclusion

The current storage charge of N2.58 per liter as foisted on depot operators by the PPPRA is clearly inadequate to cover the capital and operational expenses of the average depot. The depot owners regularly incur considerable losses in their trading operations and have borne these losses for decades. This should not be allowed to continue for as long as the objective of the government is the long-term sustainability of the Nigerian economy.

Sources:

- Sahara Reporters

- Christopher Ehinomen / Adepoju Adeleke, Department of Economics and Business Studies, Redeemer’s University, Ogun State

- Seveso Inspection Series – Volume 1

- MOMAN / FSDH Downstream Mapping Report

- Major Oil Marketers Association of Nigeria (MOMAN)