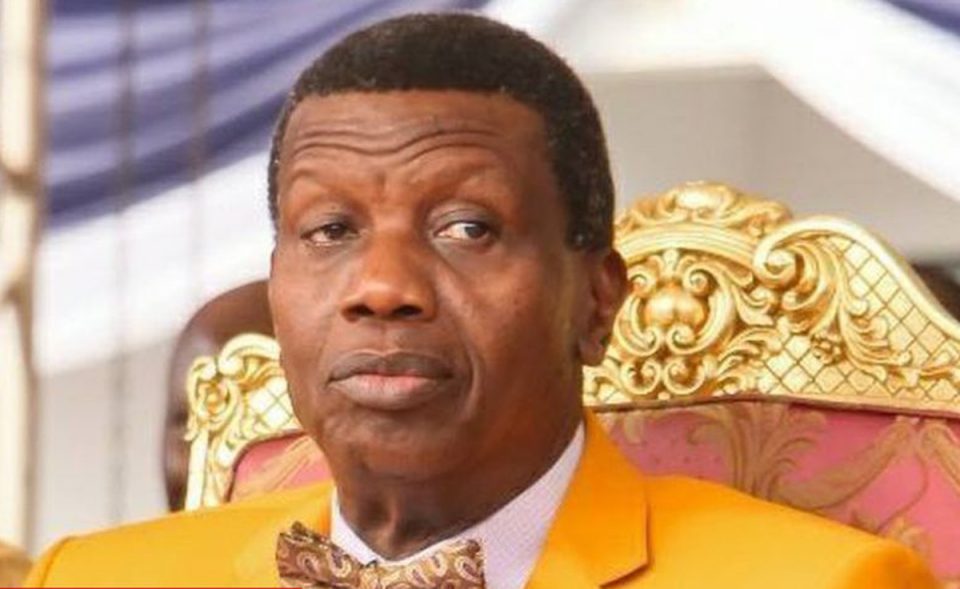

As Pastor Enoch Adeboye, the General Overseer of the Redeemed Christian Church of God(RCCG), cautioned the Federal Government on borrowing spree, the country’s foreign borrowing in the last 10 years has ballooned by 400 per cent, analysis has shown. Nigeria, like the rest of the world, has been grappling with the double-whammy impact of the COVID-19 pandemic and a significant revenue shortfall, raising concerns around the country’s foreign debt servicing.

Specifically, in 2011, the country’s foreign borrowing stood at $2.26 billion compared to $31.48 billion as at June 2020.

Nigeria accumulated an average of $1.5 billion in foreign debt each year between 2011 and 2016, bringing its total obligation to external creditors to $11.41 billion at the end of the period.

The figure rose to $18.91 billion in 2017; $25.27 billion in 2018; and $27.68 billion in 2019. External borrowings are usually obtained from foreign commercial banks, international financial institutions such as the IMF and World Bank. Domestic borrowing still accounts for over 60 percent of Nigeria’s debt composition.

Nigeria’s external debt to GDP has remained low significantly at 8 percent in 2020, and by estimates, 6.3 percent in 2019 compared to some African countries such as Zambia, Egypt, and Kenya.

However, a debt-to-GDP may not be the best indicator of debt sustainability, especially in a country like Nigeria where tax-to-GDP hovered around an abysmal 6 percent in 2019.

Financial analysts believe a better indicator of debt sustainability is the debt service-to-revenue (DSCR) ratio. The DSCR is a measure of the cash flow available to pay current debt obligations.

Olaoluwa Boboye, an economist at CSL Stockbrokers, said the high interest in repaying the debt has put Nigeria’s low debt-to-GDP vulnerable to shocks.

“In 2016, when we had an oil price shock, the country’s external debt spiked significantly; same this year, external servicing would spike due to pressured revenue of the government,” he said.

Boboye explained that debt servicing during the period of shocks is always terrible, once there is currency devaluation and a slump in crude oil prices.

According to the medium-term expenditure framework and fiscal strategy (MTEF/FSP) report recently released by the federal ministry of finance, budget, and national planning, as at first quarter for the period ended March 31, Nigeria incurred a total sum of N943.12 billion in debt servicing.