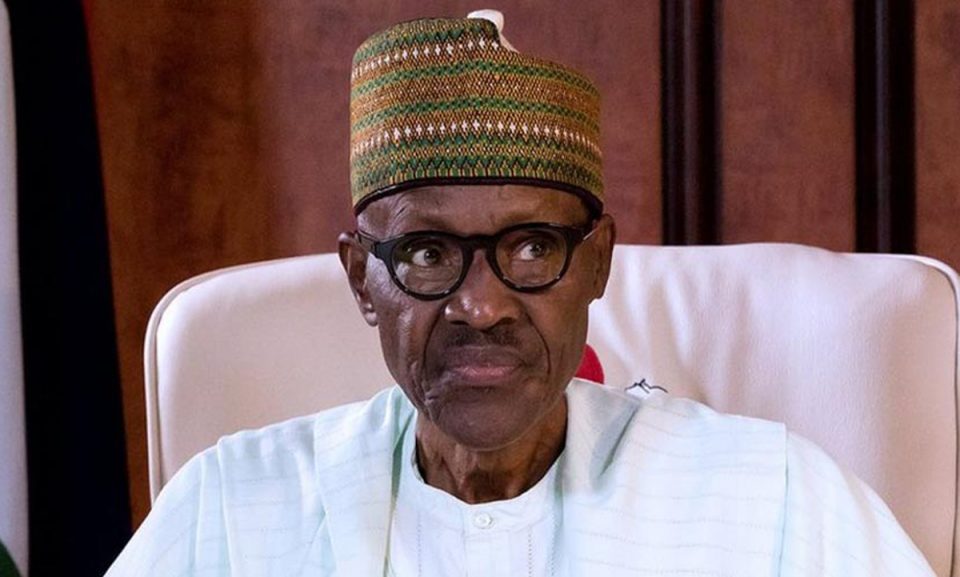

At the inception of the present regime on May 29, 2015, President Muhammadu Buhari expressed his intention to diversify the Nation’s economy and move it away from sole dependence on crude oil.

Top on the government’s list of diversifiable alternatives was agriculture. Government’s intention was to ensure that the country developed the agriculture sector to a point where it will complement crude oil receipts with huge exportation of agricultural products. The idea was for the country to boost agricultural production and for Nigeria to reverse its negative balance of payment on food.

The first step, however, will be for the nation to achieve self sufficiency in food by, at least, “growing what we eat,’’ and then, put a stop to the reckless importation of food items. This was supposed to help save scarce foreign exchange which can then be used for other more pressing needs.

Critical to achieving food security was the need to support Nigerian farmers, majority of whom were involved in small scale, subsistence farming, to explore large scale, mechanised and commercial agriculture. This led to the idea of an Anchor Borrowers’ scheme which was driven by the Central Bank of Nigeria (CBN)

The Anchor Borrowers’ Programme (ABP) which was launched on November 17, 2015 by Presidet Buhari, was designed to provide farm inputs in cash and kind to Small Holder Farmers (SHFs). The programme was intended to create a linkage between Anchor Companies involved in food processing and SHFs of the required key agricultural commodities through the commodity associations.

The President went ahead to stop the CBN from providing foreign exchange to food importers, so as to encourage local food production, which he said, was a step towards food security.

Buhari recently reiterated his premium on agriculture during a meeting with members of his economic team, where he told Nigerians that dependence on receipts from crude oil sale could no longer sustain the nation’s economy.

“We will continue to encourage our people to go back to the land. Our elite is indoctrinated in the idea that we are rich in oil, leaving the land for the city for oil riches.

“We are back to the land now. We must not lose the opportunity to make life easier for our people. Imagine what would have happened if we didn’t encourage agriculture.

“Now the oil industry is in turmoil. We are being squeezed to produce at 1.5 million barrels a day as against a capacity to produce 2.3 million. At the same time, the technical cost of our production per barrel is high, compared to the Middle East production,’’ he said.”

The initial commodity of focus in the ABP was rice but over time the commodity window was expanded to accomodate more commodities like maize, cassava, sorghum, cotton and even ginger. Beneficiaries of the programme started from an initial 75,000 farmers from 26 states of the federation, but has now been expanded to cover about three million farmers across the 36 states of the federation and the Federal Capital Territory.

Farmers captured under the programme include those cultivating cereals, cotton, tuber, sugarcane, tree crops, legumes, tomato and livestock. The programme enables farmers access agric loans from the CBN to expand their farming activities and improve on their yield.

The loans are distributed to beneficiaries through Deposit Money Banks, Development Finance Institutions and Micro Finance Banks, all of which the ABP recognises as Participating Financial Institutions (PFIs).

On harvest, farmers are expected to repay their loans with harvested produce which must cover the loan, including principal and interest, to an “anchor’’ who then pays the cash equivalent to the farmer’s account. The anchor could be a large-scale, private integrated processor or a state government. In the case of Kebbi, for instance, the state government is the anchor.

The ABP commenced with a take-off grant of N220 billion Micro, Small and Medium Enterprises Development Fund (MSMEDF), through which farmers got loans at nine per cent interest. They are expected to repay based on the gestation period of their commodities.

Mr Godwin Emefiele, Governor of the CBN, while appraising the ABP recently, said that the programme has proven to be a game changer in the financing of SHFs in Nigeria.

“The programme has revolutionised agricultural financing and has remained a fulcrum for transformation initiatives in the agricultural sector. Beyond being a tool for economic empowerment, job creation and wealth redistribution, it has also galvanised financial inclusion in our rural communities’’ he said.

Emefiele said that, with a population of about 200 million, continuous importation of food items would drain the country’s external reserves, export jobs to the countries where those food items are produced and distort commodity value chains.

“We will not be able to guarantee the supply of raw materials to our agro-allied companies if we do not discard the idea of importing food items and increase local production,’’ he said.

As a means of ensuring food security and further encouraging farmers in the midst of risks posed by the COVID-19 pandemic as well as floods that ravaged several farming communities across Northern Nigeria, the CBN, under the aegis of ABP recently approved additional incentives, through which it will share equal risks with the SHFs.

The new initiative was expected to boost food production while checking inflation tide and slashing farmers’ risk portfolio of 75 per cent to 50 per cent. It would increase the apex bank’s collateral guarantee to 50 per cent from 25 per cent.

Mr Yusuf Yila, CBN director of Development Financing, assured the farmers that the bank was open to suggestions that would help eliminate their challenges and boost productivity.

“The primary objective is massive financing of farmers for the dry season cultivation as part of our intervention on some focal commodities.

“This intervention is apt at this crucial stage of our economic development given recent happenings in the country, including the COVID-19 pandemic,’’ he said.

Yila emphasised that the programme had lifted thousands of SHFs out of poverty and generated millions of jobs for unemployed Nigerians.

He said that the ABP was characterised by the use of high-quality seeds and establishment of off-take agreements which guarantee ready market for farmers at agreed market prices.

As a way of supporting government’s economic diversification, the CBN recently engaged 256,000 cotton farmers, under the ABP, for the 2020 planting season.

Yila said that because of the commitment of the bank to cotton production, textile industries now had enough supply of locally produced cotton.

“CBN is trying to bring back the glory of textile of those days when the industry used to employ 10 million people across the country.

“In the 1980s we lost that glory because of smuggling, and our country was turned into a dumping ground for textile materials,’’ he said.

He lamented a situation where the country spent five billion dollars on importation of textile materials, adding that the bank was taking steps to ensure that the entire value chain in the industry was funded for the benefit of the people and the country.

He described agriculture as the next big thing after oil.

Mr Chika Nwaja, Head of ABP in the apex bank said that since 2015 when it was first launched, the programme had spearheaded food revolution in Nigeria.

Nwaja said that the programme now accomodates three million farmers who cultivate 1.7million hectares of farmland. He called on stakeholders to adopt improved agricultural techniques for better yields.

“While other parts of the world are already in the fourth agricultural revolution which is digital, Nigeria is still grappling with the second revolution which is mechanised farming,’’ he said.

Two initial beneficiaries of the agriculture revolution of the federal government, and the ABP were Kebbi and Lagos states. Both states went into a collaboration that birthed the LAKE Rice initiative. That initiative has now resulted to the construction of a multi-billion Naira 32 Metric Tonnes per hour capacity rice mill by the Lagos state government.

The rice mill was conceptualised by former Lagos Governor, Akinwunmi Ambode, and its scheduled to be completed in the first quarter of 2021.

Ms Abisola Olusanya, Lagos State Commissioner for Agriculture said that the mill would strengthen the economic rigour of the nation and enhance economic resilience by providing employment opportunities for Nigerians through the creation of 250,000 jobs.

Olusanya stressed that the facility will help to create wealth across the Agricultural value chain.

Also, Abubakar Bello, President of Maize Association of Nigeria , while commending CBN for providing high yielding maize seeds to members through the ABP, assured that the country would soon be self sufficient in maize production.

Overall, the Anchor Borrowers ‘ Programme of the CBN has proved to be a critical intervention in Nigeria’s agricultural sector which, if sustained, would help consolidate government’s policy on food security and economic growth.

The Programme, however, faces some challenges, principal among which is the inability of some of its beneficiaries to repay their loans.

CBN sources say that recouping about N240 billion ‘revolving’ credit facilities granted to small-scale farmers and processors in the programme has been hampered by COVID-19 pandemic.

Stakeholders fear that the inability to recoup the loans spells doom for further deepening of sustainable agricultural financing and food security objectives as envisaged by the scheme’s policy formulators.

Many Nigerians are, however, optimistic that the Anchor Borrowers’ Programme, if well nurtured and strengthened, would go a longer way to boost the country’s food security and also boost economic diversification efforts as well as increase foreign exchange earnings of the country.