The newly redefined and standardised cheque for the banking system has taken off. The new cheque rule took effect on January 1, 2021.

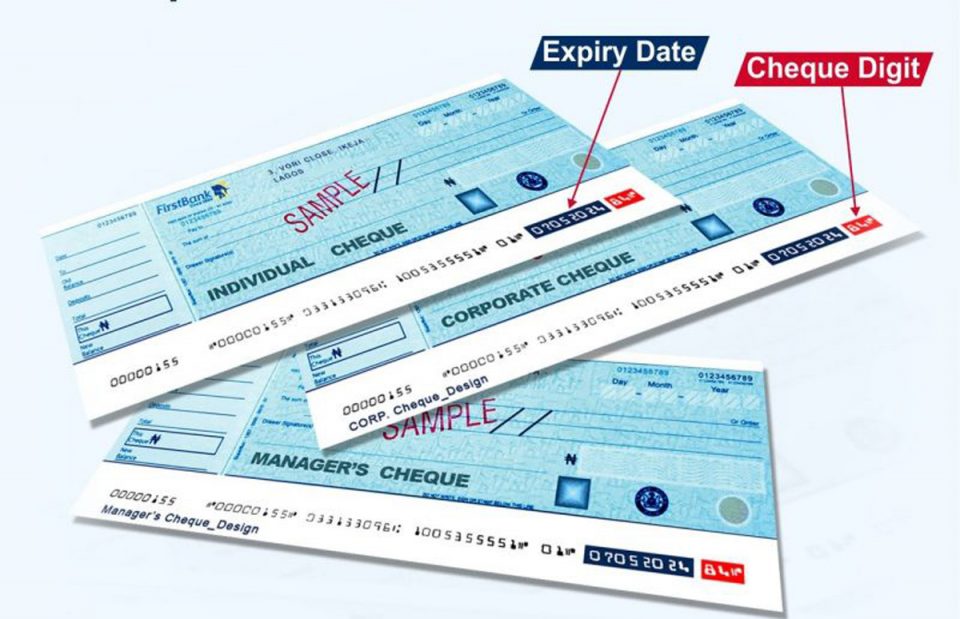

The Central Bank of Nigeria (CBN) had approved a cheque standard plan that includes new digit on the magnetic ink character recognition code line and expiry dates for cheque books.

The new and old cheques had run concurrently since introduction, but now only cheques that conform with the new standards would be allowed in the clearing system.

Banks yesterday confirmed the commencement of the new cheque standard, urging their customers to pick up new cheque books at their nearest branches.

In a message to its customers, United Bank for Africa (UBA) Plc, stated that the new cheque was designed to improve the security of transactions and make cheque processing faster and more secure.

On how to identify the new cheques, UBA outlined that the new cheques have thinner and longer spacing for “Payee” and “Amount in words”, dateline is now labelled “Day, Month and Year” while location of “Amount in figures” has moved from directly under “Date” to directly under “Amount in words”.

Other distinguishing features include signature line, which moved from directly under the space for “Amount in figures” to directly under the space for “Amount in words while control number changed from eight digits to 10 and has moved to the top right corner of the cheque.

FirstBank of Nigeria Limited also confirmed the take off of the new cheque. Other banks have also informed their customers about the new cheque policy.

The CBN had emphasised its commitment to ensuring an enabling environment for efficient cheque processing and other paper-based payment instruments through complete application of new and already adopted technologies.

In its Monetary, Credit, Foreign and Exchange Policy Guidelines for Fiscal Years 2020/2021, the CBN said it would continue to improve the clearing infrastructure to increase the efficiency of the system.

“The cheque truncation system shall continue to be used for the exchange of images of the instruments and Magnetic Ink Character Recognition (MICR) data. The cheque clearing cycle remains T+1 and maximum cap on cheque at N10.0 million. The bank will continue to take necessary steps to achieve a clearing cycle of T+0,” the apex bank stated.

According to the regulator, the revised Nigeria Cheque Standards (NCS) and Nigeria Cheque Printers Accreditation Scheme (NICPAS) was approved to improve the safety and efficiency of the clearing system.

Notable changes in the revised standards include introduction of Quick Response (QR) Code for faster verification of cheque details, expiry date of printed cheque booklet and clear zone at the back of the cheque.

The apex bank said it would continue to conduct annual accreditation of the Nigeria cheque printers and cheque personalisers, in line with the provisions of the revised NICPAS.