The House of Representatives is considering raising the capital base of the Federal Mortgage Bank of Nigeria from the current N5bn to N100bn.

Also, the mortgage bank may also be opened to private investors and shareholders.

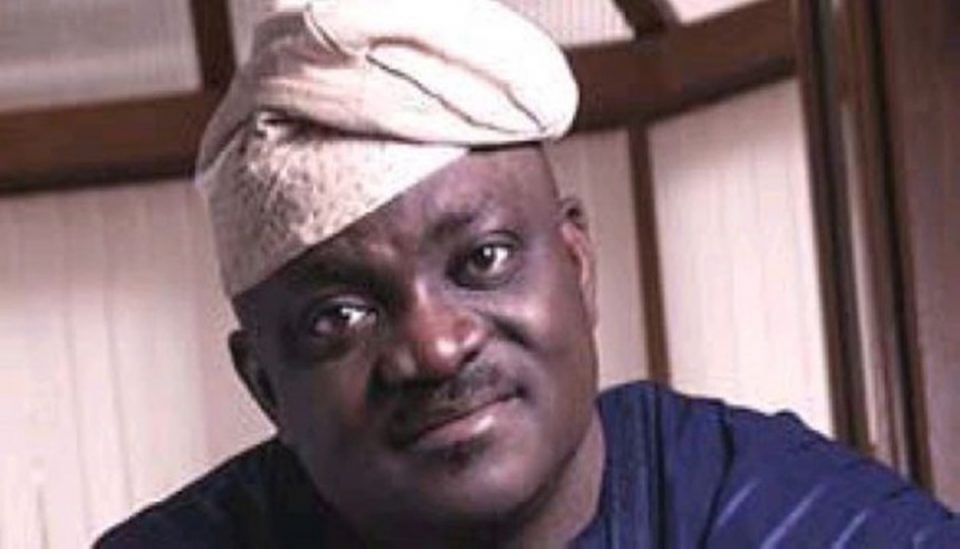

These are proposed in the Federal Mortgage Bank of Nigeria Act (Amendment) Bill, 2021, sponsored by Chairman of the House Committee on Public Accounts, Mr Wole Oke.

Oke, in the explanatory note to the proposal said, “This bill seeks to amend the Federal Mortgage Bank of Nigeria Act 1993, by introducing a new Section 11 Subsections 2 and 3, permitting private sector investors to participate in the shareholding arrangement of the bank.”

The ‘Bill for an Act to Amend the Federal Mortgage Bank of Nigeria Act 1993’, which is awaiting second reading by the House, seeks to particularly amend Section 11(2) and (3) of the Act by including and replacing the current provision with a new provision.

The new provisions read, “(2) The authorised capital of the mortgage bank shall be N100,000,000,000 which shall be divided into 1,000,000,000 shares of N1.00 each and be subscribed and paid up at par by the Federal Government of Nigeria, development banks, pension fund administrators and any other investors authorised by the board of directors.

“(3) The loan capital of the mortgage bank shall be provided by the Federal Government of Nigeria, development banks, pension fund administrators and any other investor authorised by the minister, based on such amount and on such terms as may be determined by the board of directors.”

Section 11 would further be amended by introducing a new Subsection 4 that reads, “The shareholders of the mortgage bank shall be entitled to increase the authorised capital in order to accommodate more investment funds.”