The Nigerian National Petroleum Corporation (NNPC) started the week with cheerful news from the Federal Government that it was targeting to grow the nation’s oil reserves to 40 billion barrels and four million barrels production capacity per day.

President Muhammadu Buhari, who stated this at the opening of the 4th edition of the Nigeria International Petroleum Summit (NIPS) in Abuja, reiterated the government’s determination to build up the nation’s crude oil reserves in few years to come.

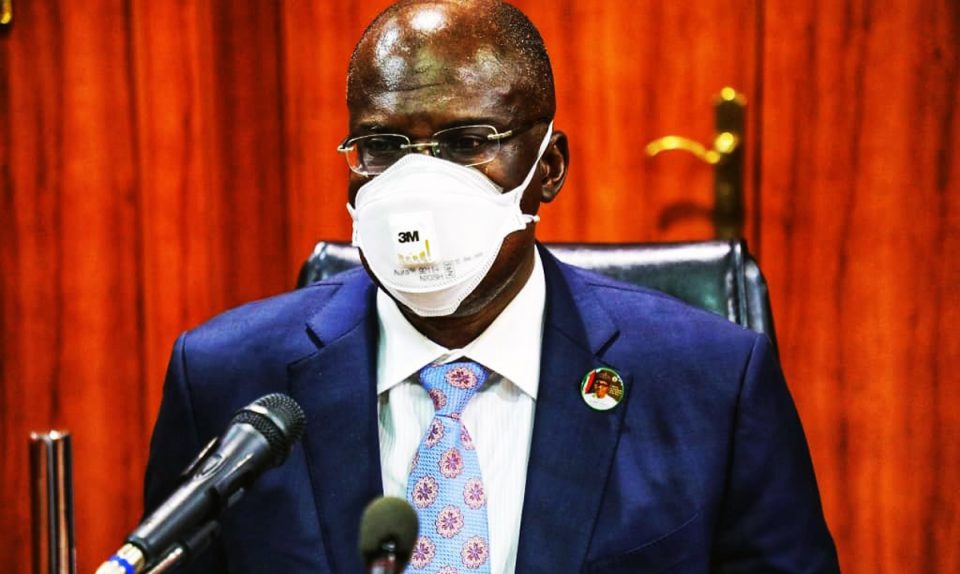

Buhari, represented by Minister of State for Petroleum Resources, Chief Timipre Sylva, said the Federal Government intended to achieve the crude oil reserve growth through the marginal oilfields commissioned by the NNPC.

The president said the buildup would be achieved notwithstanding that Nigeria now produces 1.7million barrels per day in compliance with the Organisation of the Petroleum Exporting Countries (OPEC) Plus production quota.

“My administration has demonstrated commitment to overhaul the oil and gas industry. The ambitious goal of ramping up crude oil production to at least 4.0 million barrels per day and building a reserve of 40 billion barrels remains sacrosanct and guiding principle to our overall outlook for the industry.

“Creating a conducive business environment for hydrocarbon industry to thrive is no longer a choice; it is a necessity.”

According to him, the theme of the summit “From Crisis To Opportunities – New Approaches to the Future of Hydrocarbon,” reflects the need to adopt new approaches to the future of hydrocarbons by redefining objectives and providing the pathway for rediscovery.

He said governments across the world were now more focused on managing the COVID-19 pandemic and its impact on economies than the quest for energy transition.

The President said: “However, energy transition is real, renewable technologies are getting cheaper and investors are increasingly conscious of environmental issues, and are beginning to turn their back on hydrocarbon investments.

“Experts have projected that about 80 per cent of the world’s energy mix in 2040 would still come from hydrocarbons.”

The President further noted that Nigeria must address short-term opportunities, using existing technology that can extend the life of mature fields.

President of the Senate, Ahmad Lawan, who was also in attendance said the National Assembly would pass the much-awaited Petroleum Industry Bill (PIB) before the end of June.

He noted that the ninth National Assembly legislative agenda for 2019-2023 was for it to support the effort of the executive to deliver a PIB that would provide a win-win scenario for Nigeria and investors.

Speaker of the House of Representatives, Femi Gbajiabiamila, OPEC Secretary-General, Dr Mohammed Sanusi Barkindo, the Secretary-General of the Gas Exporting Countries Forum (GECF), His Excellency, Yury Sentyurin, as well as Dr Omar Farouk Ibrahim, Secretary-General of the African Petroleum Producers’ Organization (APPO), also spoke at the event.

Still on NIPS, the NNPC has disclosed plans to diversify its investment portfolio in a bid to transform into an international Energy Corporation away from a traditional oil and gas company.

The Group Managing Director (GMD) of the NNPC said that the Corporation was considering a name-change to reflect its plan to diversify into renewables energy and non-oil and gas assets such as healthcare, research, technology, innovation, telecommunication and real estate.

Kyari also said the Corporation was working to maximize the exploration and exploitation of the massive hydrocarbon resources in the country before oil and gas lapse into economic irrelevance like coal.

The GMD asserted that the Nigerian Government was determined to create the right legislations and policies to support investment and growth through the passage of the PIB, stressing that there was a need for urgent exploration campaign as oil production in Sub-Saharan Africa would almost deplete significantly by 2050.

According to Kyari, Nigeria holds about 36.9billion barrels of oil and 203trillion cubic feet of gas reserves, which he said translates to 60 per cent and 78 per cent of the oil and gas reserves respectively in sub-Sahara Africa.

He said Nigeria remains focused on increasing domestic gas supply and utilization to fuel power generation and industries as parts of the Federal Government ‘Decade of Gas’ aspirations.

On emerging opportunities in Africa, Kyari said relatively less explored countries in West and East Africa present opportunities as the next frontiers of exploration, stressing that new transform margin provinces include Sierra Leone, Ghana, Uganda, Kenya and Mozambique.

He hinted that NNPC would declare dividend for her shareholders when the 2020 Audited Financial Statement is released.

He said the Corporation’s commitment to transparency and accountability has paid off as it has opened doors of financing where others find it difficult to raise loans.

Also in the week, the Nigerian Senate commended the NNPC for its efforts towards entrenching transparency and stamping out corruption from its system.

The commendation was by the Chairman of the Senate Committee on Anti-Corruption and Financial Crimes, Sen. Suleiman Kwari, at a hearing in Abuja to assess the level of implementation of the National Anti-Corruption Strategy by government agencies and parastatals.

Kwari said it was heartwarming that the NNPC was making great strides towards profitability and urged the Corporation to sustain the gains recorded so far for the good of the country.

The NNPC GMD, during his presentation, said the Corporation, as part of its commitment to the war against corruption, has set up processes and structures that would ensure transparency and accountability.

He said the Corporation, in collaboration with security agencies, had reduced the incidences of pipeline vandalism to four per cent across the country.

He, however, decried the rise in smuggling of petroleum products, which he said had become a national challenge that must be addressed urgently to stem the huge loss to the nation.

Still in the week under review, the NNPC recorded over 1million euros through the monetisation of its carbon credit in the operation of its Joint Venture partnership with TotalEnergies.

The Group General Manager, National Petroleum Investment Management Services (NAPIMS), Mr Bala Wunti, who disclosed this on the sidelines of the recently concluded NIPS in Abuja, spoke on the benefits of a Carbon credit.

Wunti described Carbon credit as a permit which allows a country or organization to produce a certain amount of carbon emissions which can be traded off or converted to cash if the full allowance is not used.

He stated that the positive carbon credit which was converted to more than one million euros is an additional revenue inflow which could be replicated in the emerging energy transition scenario.

Wunti explained that the transition to renewables has led to lack of investments in hydrocarbons by the IOCs which could lead to shortage of supply in future if not properly managed.

He also identified the delay in the passage of the Petroleum Industry Bill (PIB), security and high cost of operation as impediments to the competitiveness of Nigeria’s oil and gas industry.

He said the passage of the PIB, improved collaboration among stakeholders in the industry to curb insecurity as well as the reduction of cost of crude oil production to 10 dollars per barrel would make Nigeria a top investment destination.

Also in the week, the NNPC called on the international oil companies operating in Nigeria to invest in the Downstream Sector to boost products availability and sustainable growth in the oil and gas industry.

The Group General Manager, Crude Oil Marketing Division, Billy Okoye, who also spoke on the sidelines of NIPS in Abuja, commended private companies that were currently investing in refineries in the country.

He said cost optimization programme was central to a successful energy transition as funds would be freed to invest in renewables and gas optimization projects.

On a concluding note, NNPC congratulated the President of the Nigerian Guild of Editors (NGE)), Mr Mustapha Isa, on his re-election as the president of the Guild.

Kyari, in a congratulatory letter, stated that Isa’s re-election did not come to him as a surprise.

He stated that his re-election was a reaffirmation of his integrity, dedication, work ethics and outstanding contributions to the Guild, urging him to take the guild to greater heights in his second tenure.

It will be recalled that Isa was re-elected at the 2021 Biennial Convention of the Guild which held recently in Kano.

At the global market, oil prices rose for a second session on signs of strong fuel demand in western economies, while the prospect of Iranian supplies returning faded as the United States of America secretary of state said sanctions against Tehran were unlikely to be lifted.

Brent crude futures were up 32 cents, or 0.4 per cent at 72.54 dollars per barrel, having earlier touched 72.83 dollars, the highest since May 20, 2019, while the United States of America West Texas Intermediate (WTI) crude futures climbed 31 cents, or 0.4 per cent to 70.36 dollars per barrel, after rising to as high as 70.62 dollars, highest since Oct. 17, 2018.

Meanwhile, the Market Intelligence Department of NNPC’s London Office reported that global inventories have continued to draw in spite of recent demand setbacks, notably in India, the world’s third-largest oil importer.

The Organisation of the Petroleum Exporting Countries (OPEC) plus has shown that it remains in control and will return inventories to their pre-COVID-19 baseline.

This maintains the backwardation on the price curve, which is clearly the bloc’s preferred price structure.

Yet some analysts note that stockpiles are still sizable and that speculative pressure in the paper markets has waxed bullish on oil prices, somehow deepening backwardation in spite of evidence of a large and resilient supply surplus.

According to Energy Intelligence balances, once the current round of tapering finishes in late July, producers will still be keeping about 5.8 million barrels per day of production off line.