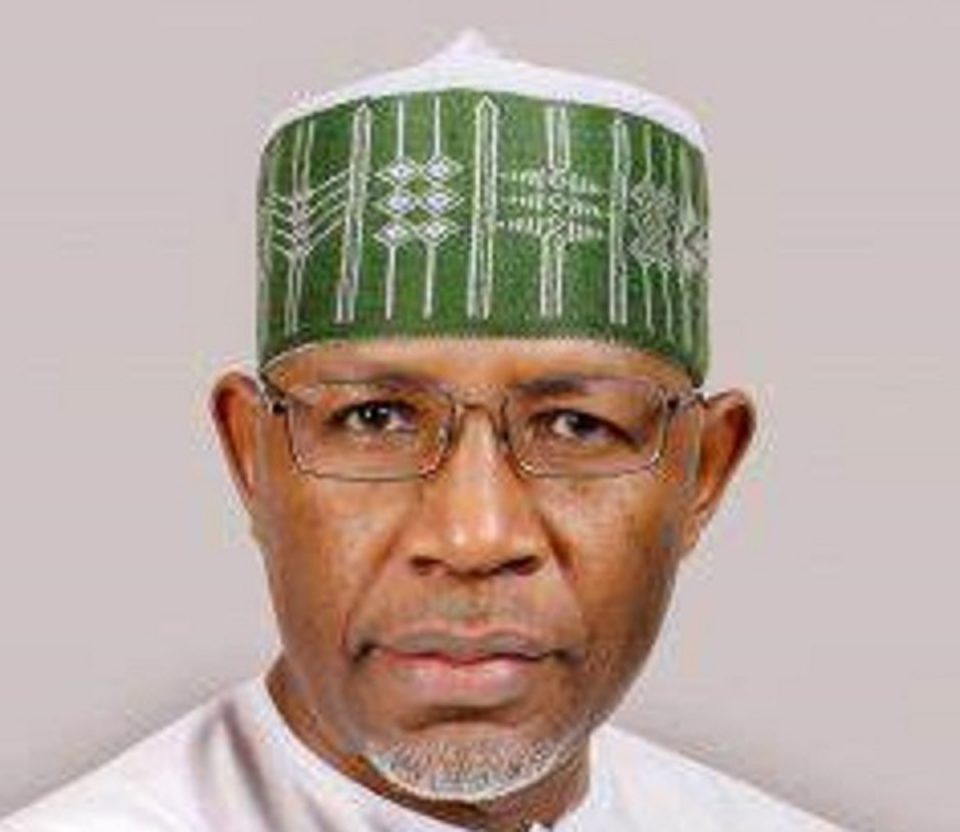

The Progressive Shareholders Association of Nigeria (PSAN) has advised Mr Lamido Yuguda, the new Director-General, Securities and Exchange Commission (SEC) to initiate policies to woo investors back to the market.

Mr Boniface Okezie, PSAN National Coordinator, gave the advice on Wednesday in Lagos.

Okezie said the new D-G should embrace policies that would woo retail investors back to the market, especially those who left due to losses recorded during the global financial meltdown.

He also tasked Yuguda to reduce transaction charges on the Nigerian Stock Exchange (NSE) so as to deepen investment in the capital market.

He stressed the need for the new D-G to strengthen relationship between the commission and shareholder groups in the market.

According to Okezie, there is a need for a round table discussion between the commission and shareholders on ways to move the market forward.

He urged him to give the capital market a new direction to boost investors’ confidence.

Okezie observed that investors’ confidence in the SEC, in the last two years, had been affected as there was no substantive D-G for the period.

He, therefore, commended President Muhammadu Buhari for appointing Yuguda.

He urged Yuguda to ensure round pegs were fixed in round holes in the commission for effective service delivery.

President Buhari nominated Yuguda as the substantive SEC Director-General on May 19.

The development ended uncertainties around the leadership of SEC since the suspension of a former D-G, Mr Mounir Gwarzo, by a former Minister of Finance, Mrs Kemi Adeosun.

In a letter read at the Senate, Buhari had requested the red chamber to consider and approve the nomination of Yuguda as SEC D-G in line with the requirements of the “Investment and Securities Act’’.

Also to be confirmed are three other nominees as full-time SEC commissioners.

They are Reginald Karawusa, Ibrahim Boyi and Obisan Joseph.