The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRC) yesterday met with the Nigerian National Petroleum Corporation (NNPC) and other key stakeholders in the petroleum products supply and distribution where they took critical resolutions to ensure steady supply and distribution of petrol nationwide.

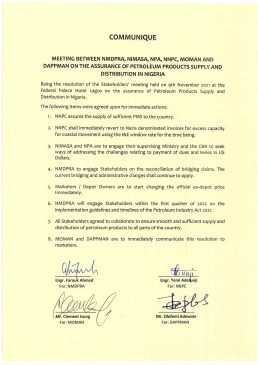

Among the decisions taken at the meeting held in Lagos yesterday, which were contained in an eight-point communique read by the Chief Executive Officer of NMDPRA, Mr. Farouk Ahmed, was for NNPC to immediately revert to the naira-denominated invoices for excess capacity for coastal movement of petroleum products, using the Investors’ and Exporters’ (I&E) window rate for the time being.

Other stakeholders present at the meeting included the Major Oil Marketers Association of Nigeria (MOMAN); Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN); Nigerian Port Authority (NPA); and Nigerian Maritime Administration and Safety Agency (NIMASA).

According to the communique jointly signed by the heads of the stakeholder groups, the NPA and NIMASA should engage their supervising ministry and the Central Bank of Nigeria (CBN) to seek ways of addressing marketers’ challenges relating to payment of dues and levies in dollars.

While agreeing that the NMDPRA should engage stakeholders on the reconciliation of bridging charges paid marketers to ensure balance in products pricing in the country, the stakeholders also agreed that the current bridging and administrative charges shall continue to apply.

They resolved that marketers and depot owners should start charging the official ex-depot price with immediate effect.

Ahmed said, “Being the resolution of the stakeholders’ meeting held on November 9, 2021, at the Federal Palace Hotel, Lagos on the assurance of petroleum products supply and distribution in Nigeria.”

The other resolutions at the meeting included: “NNPC assures the supply of sufficient PMS to the country. NNPC shall immediately revert to naira denominated invoices for excess capacity for coastal movement using the Investors’ and Exporters’ (I&E) window rate for the time being.

“NIMASA and NPA are to engage their supervising Ministry and the CBN to seek ways of addressing the challenges relating to payment of dues and levies in US Dollars.

“NMDPRA to engage Stakeholders on the reconciliation of bridging charges. The current bridging and administrative charges shall continue to apply.

“Marketers/Depot Owners are to start charging the official ex-depot price immediately.”

He added that NMDPRA would engage stakeholders within the first quarter of 2022 on the implementation of guidelines and timelines of the Petroleum Industry Act (PIA) 2021.

He urged MOMAN and DAPPMAN representatives at the meeting to immediately communicate the resolution to their member marketers.

However, prior to reading the eight-point communiqué, Ahmed said the stakeholders’ meeting was called for them to engage on the critical sector of the petroleum industry, particularly the downstream sub-sector.

He said one of the key issues discussed was the supply and distribution of petroleum products in the country and other pressing issues that affects the stakeholders like marketers, transporters and other related concerned associations and Nigerian consumers.

Ahmed recalled concerns around perceived scarcity of petroleum products, particularly petrol, allaying the fears of Nigerians that there was abundance of petroleum products, particularly petrol in the country.

According to him, “We have all agreed that the supply and distribution shall continue unhindered. But of course, there were some concerns raised by the marketing companies -MOMAN, DAPPMAN, concerning logistics of deliveries and the financing of the logistics.

“So, we called the meeting of all stakeholders -MOMAN, DAPPMAN, NIMASA, NPA, NNPC to deliberate on these concerns and see ways of addressing the complaints or situation.

“After the deliberations and consultations, we arrived at a conclusion, which I’m happy to say, will bring relief to all Nigerians and the supply and distribution of petroleum products shall continue unhindered.”

Also, speaking to journalists after the meeting, Ahmed said marketers complained of the high cost they were suffering in shipping products from the coastal vessels to their depots, as they have to buy dollars at the parallel market at higher rates.

He said the marketers complained about not getting enough FX access from the CBN, hence the need for NNPC to help them in cushioning that effect.

He added that the markers also complained about the charges by NIMASA for their services, the charges by NPA for the port services, as well as NNPC, for helping to collect naira for their freight charges in naira rather than in dollars.

He explained, “So, now, we all agreed that NNPC for now, will withdraw that naira-denominated payment for the excess vessels they charter to marketers and collect naira. And once they do that, then that additional cost the marketers put at the depot where they charge about N9 on the average over the official ex-depot price, they said they will withdraw it immediately and continue selling at the official ex-depot price.

“By so doing, it will help the pump price where you go to some locations outside maybe, Lagos and Abuja, you see that they are selling above the official price. Now, they will bring it down to the official retail outlet price.”

Ahmed further said that another issue deliberated on at the meeting was the bridging fund which was being coordinated by the defunct Petroleum Equalisation Fund (PEF) to ensure parity of petrol price nationwide, saying that has not been scrapped.

He assured marketers that their outstanding and current bridging claims would be paid so long as they followed proper process.

“Another issue we discussed is concerning the bridging claims. The transporters claim bridging for moving product from end of the country to the other, and the insinuation was that that bridging charges has been withdrawn. No, it has not been withdrawn. It’s still on.