Currently, the refineries in Nigeria are idle with all petroleum products being imported either through the NNPC’s Direct Sale Direct Purchase (DSDP) program or through purchases at external refineries by NNPC or the private sector.

The journey of importation into Nigeria therefore begins from these international refining hubs.

Currently, the refineries in Nigeria are idle with all petroleum products being imported either through the NNPC’s Direct Sale Direct Purchase (DSDP) program or through purchases at external refineries by NNPC or the private sector.

The journey of importation into Nigeria therefore begins from these international refining hubs.

Various grades of crude oil, ranging from very light oils to heavy fuel oils are bought and shipped to these refineries all over the world. The world has come a long way from the earliest forms of the refining process that employed simple distillation units to separate the various constituents of petroleum. After the delivery of crude oil to be refined into petroleum products had reached almost 2.3 billion tons per year (40 million barrels per day), with major concentrations of refineries in most developed countries, the world became aware of the impact of industrial pollution on the environment. The petroleum industry began the process of adding hydrotreating units to extract sulfur compounds from their products. The industry was then required to develop techniques for manufacturing high-quality gasoline without employing lead additives, taking on substantial investments in the complete reformulation of transportation fuels in order to minimize environmental emissions. This brought about the closure of many refineries and the emergence of the mega refineries and refining hubs, serving as a gateway for regional supply across the continents.

Hubs are at the core of the petroleum industry’s efficiency. The supply/demand balance in a hub is the key to price levels in the surrounding region, dictating price differentials. The most efficient refining hubs to import petroleum products from to Nigeria are Rotterdam and Arabian Gulf. For benchmarking purposes, PPPRA uses Rotterdam.

Hubs are at the core of the petroleum industry’s efficiency. The supply/demand balance in a hub is the key to price levels in the surrounding region, dictating price differentials. The most efficient refining hubs to import petroleum products from to Nigeria are Rotterdam and Arabian Gulf. For benchmarking purposes, PPPRA uses Rotterdam.

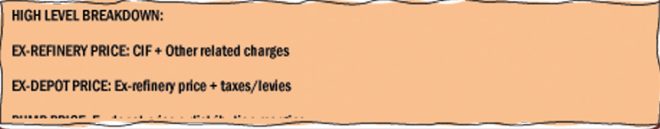

Shifting focus to the PPPRA price template, the factors that go into determining the fuel price are as follows:

- Product cost

- Freight cost

- Lightering expenses

- Insurance

- NPA charges

- NIMASA charges

- Jetty throughput charges

- Storage charge

- Financing

- Wholesale

- Distribution margins (NTA, Retailer margin, Bridging fund, MTA and PPPRA Admin charge)

The addition of the first 9 items sum up to the product’s landing cost, or the cost of product sold at the depot.

Coastal Price

This is where the process begins for Nigeria. The country currently operates a DSDP program, where it swaps its crude oil for European fuel refined mainly in Belgium and Netherlands. Nigeria receives petroleum products from Ex-Rotterdam for delivery to Lagos Offshore, this is what we also refer to as Coastal. This Coastal price which is the amount of money equivalent to the actual cost of importing finished petroleum products is usually anchored at full cost recovery. It consists of:

- The FOB price: a function of the prevailing benchmark price (Rotterdam) and prevailing exchange rates

- Freight to Lome: a function of demand and supply for vessels and prevailing exchange rates

- Insurance: on average about $0.75 – $1.00 per MT

- Financial cost/borrowing cost: a function of financial terms with specific institutions but typically between $1.00 – $2.00

- Blended cost (the cost to transform gasoline to Nigeria’s specifications): on average about $5.00 / ton

- Trader’s margin: on average about $10.00 / ton

The PPPRA however only takes into consideration, the FOB price, freight and insurance (based on a fixed percentage of the FOB price) in its calculation of the Coastal price.

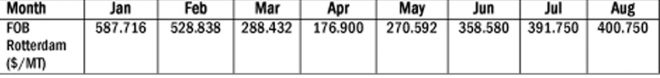

See monthly average Platts’ quotations for Premium Gasoline (10ppm) for the corresponding period in the table below:

Average prices decreased in the period from March to early June 2020, however, with the crude oil prices fluctuating, Nigerians should expect the pump price to fluctuate.

Ship-To-Ship (STS)

- Length Overall (LOA) restriction of the jetties

- Storage capacity restriction of the receiving terminal

- Financial capacity of the buyer

There are 4 clusters of jetties and storage tanks in the Nigerian coastal areas: Lagos, Warri, Calabar and Port Harcourt. In the petroleum industry, draft determines the minimum depth of water a ship (or boat) can safely navigate. Apapa, TinCan and Ijegun areas have some jetties with drafts deep enough to take between 20KT and 100KT vessels. The average draft in Warri can accommodate a 10-15KT vessel, Port Harcourt’s draft can accommodate a vessel of between 15-20KT and the draft in the Calabar coastal region can only take on a vessel of 5-15KT.

In the case of the NPSC owned Apapa jetty in the Lagos area, infrastructure deficit is the major reason why lightering of vessels is done. With a draft of only 7.5m, the implication is that the maximum of a 30KT vessel, depending on the vessel specification, can be berthed at the jetty. So, for every large vessel, for example, a 47KT vessel that plans to berth at the Apapa jetty, the product must be lightered into a daughter vessel with the marketers incurring costs of approximately $245,000 per lightering operation. Sometimes this might involve one or two lightering operations depending on the size of the daughter vessel and thus increasing the cost, a cost that is heavily dependent on the prevailing exchange rate. Even though the process is subject to international standards and regulations, the need for product lightering, caused by poor, underdeveloped infrastructure presents several risks such as attack by sea robbers and environmental impacts such as potential oil spills and the need for added security.

Other Charges

Also factored into the product’s landing price are the NPA (Nigerian Ports Authority) charges and the NIMASA (Nigerian Maritime Administration and Safety Agency) charges. Per the PPPRA website, the NPA includes cargo dues (harbor handling charge) charged by the Nigeria Ports Authority for use of Port facilities. The charge includes VAT and Agency expenses. NIMASA charges include provision for marine pollution prevention & control, and cabotage enforcement.

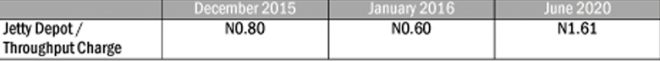

Jetty Costs

Worldwide and rapidly developing technology as well as the need to manage costs and operational risks have resulted in changes in the way jetties are managed and operated. Nigeria should not be an exception. Marine terminals and jetties are always in operation. The loading and discharge of petroleum products need to be carried out by well trained professionals with the required and up-to-date training in aspects related to health, safety, environment and quality, all governed by international regulations and standards. This is all in the bid to make operations at the jetty safer, faster and more efficient. West Africa’s first privately owned midstream jetty – the Apapa Single Point Mooring (ASPM) Limited, a subsidiary of OVH Energy, with a draft of 13.5m and is able to berth up to a 60,000 MT Displacement Weight Vessel (DWV) and transport petroleum products from the jetty through a network of pipelines to over 200,000 MT of storage facilities in Apapa aims at doing just that.

As at 2019, the average cost of building a standard jetty (land included), using ASPM as a guide was approximately N36.5 billion with an annual operating expense approximately N5.3 billion. With expected throughput volumes, it would cost an average of N1.70 to run the jetty at a level where costs are covered and a decent return on investment is made. It is quite clear that the current provision of N1.61 is inadequate.

Pipeline Network

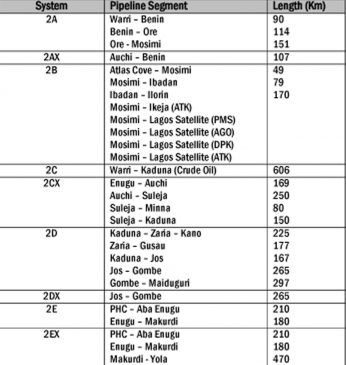

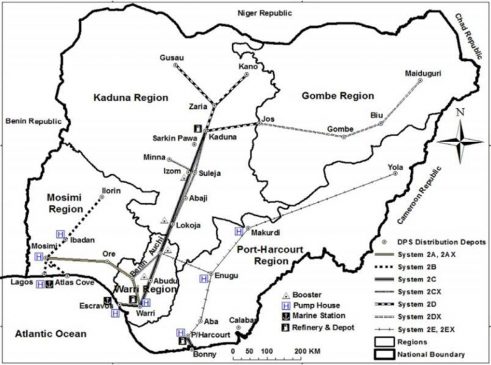

Pipelines as a mode of petroleum products transportation is extremely important. The Nigerian petroleum pipeline network is made up of a number of systems namely: 2A, 2B, 2C, 2D, 2E, 2AX, 2CX, 2DX and 2EX (see table below).

Nigeria’s current pipeline network was set up to move crude to the refineries and products from the refineries/import receiving jetties to the storage depots all across the country. The contribution of this avenue of transport has however been under threat for decades, which has led to the inability to maximize its full benefits. The challenges being faced by the other modes of transport, i.e., trucks and rail create the ripe opportunity to explore the improvement of this form of transport. The continuous long-haul transportation of petroleum products by road is a sure recipe for disaster.

The condition of the NNPC pipelines are in a much-needed state of repair. These pipelines which are strategically located across the country and are approximately 5,000 kilometers long are deteriorating and prone to natural ruptures due to the incessant vandalism, lack of maintenance and non-adherence to international standards. For example, the Network that goes from Atlas Cove – Ejigbo – Arepo – Mosimi, and eventually Ibadan, Ilorin and Ore is extremely vulnerable. The high frequency of vandalism especially around the Arepo pipeline axis has resulted in deaths of several Nigerians, prompting the government to install new HDD pipelines which have now been inserted underground. However, as these threats are still prevalent, there has been a significant reduction in the volume of products being discharged from Atlas Cove.

Sources:

- Journal of Business and Economics Research

- CBN Economic and Financial Review

- Petroleum Products Pricing Regulatory Agency (PPPRA)

- OVH Energy

- Munich Personal RePEc Archive

- Major Oil Marketers’ Association of Nigeria (MOMAN)