The Central Bank of Nigeria (CBN) yesterday highlighted security features in the redesigned naira notes to reaffirm the safety of the legal tender.

The apex bank in a display, marked out security features and peculiarities that distinctively differentiate the new naira notes and make them inviolable to counterfeiting.

The security features included, at least, 23 features on the N1,000 note, 15 features on the N500 note and 10 features on the N200 note.

The release of the demonstrative naira notes with marked security features followed reports that counterfeits of the new naira notes were already in circulation, few days after the official rollout.

There were confusion and palpable fears over the possible faking of the new naira notes, even as most Nigerians have not been able to touch the scarcely available new notes.

Many respondents who had spoken to The Nation said they were afraid of being victims of counterfeits as a viral video raised the alarm over the presence of a counterfeited N1,000 new naira note.

Respondents had said they had seen something similar to the N1,000 note claimed to be counterfeit in the viral video, saying the absence of the new notes had made it difficult for people to clearly identify the new notes.

According to the apex bank, to recognise the N1,000 notes, users should look out for intaglio raised print, portrait watermark, officially variable ink that changes from blue to green with change in angle of view, kinegram with the image of N1,000 and Coat of Arms, iridescent band, windowed metallic security thread and see through printing in register.

The security features on N500 notes included hand-engraved portrait, windowed metallic security thread with CBN inscription, CBN 500 watermark, portrait watermark, officially variable ink that changes from blue to green with change in angle of view, silver patch with embossed Coat of Arms, see through printing in register and raised intaglio print.

Also, the N200 has several security features including hand-engraved portrait, windowed metallic security thread with CBN inscription, CBN 200 watermark, portrait watermark, officially variable ink that changes from blue to green with change in angle of view, gold patch with embossed Coat of Arms, see through printing in register and raised intaglio print.

Aside, these criteria, there are also other five simple guidelines on a Naira note that will help holders of the currency to differentiate a counterfeit Naira from a genuine one.

The first step to identifying a genuine banknote from the counterfeit is to check the texture. Findings showed that a soft texture and dull image are indicators of a fake naira. That means one should be sensitive to the touch of the banknote when carrying out a transaction.

There is also need to observe the gold foil on the right side, close to the CBN governor’s signature. One can also differentiate the genuine naira note from counterfeit by applying liquid to the note, and a fake currency can easily change colour.

Also, the ribbon-like thread on all Naira notes can also be observed and touched to confirm if the note is genuine or otherwise.

One can also raise a naira notes on a mercury bulb. This exercise enables the one to see many features of the local currency, not visible to the naked eyes, among others.

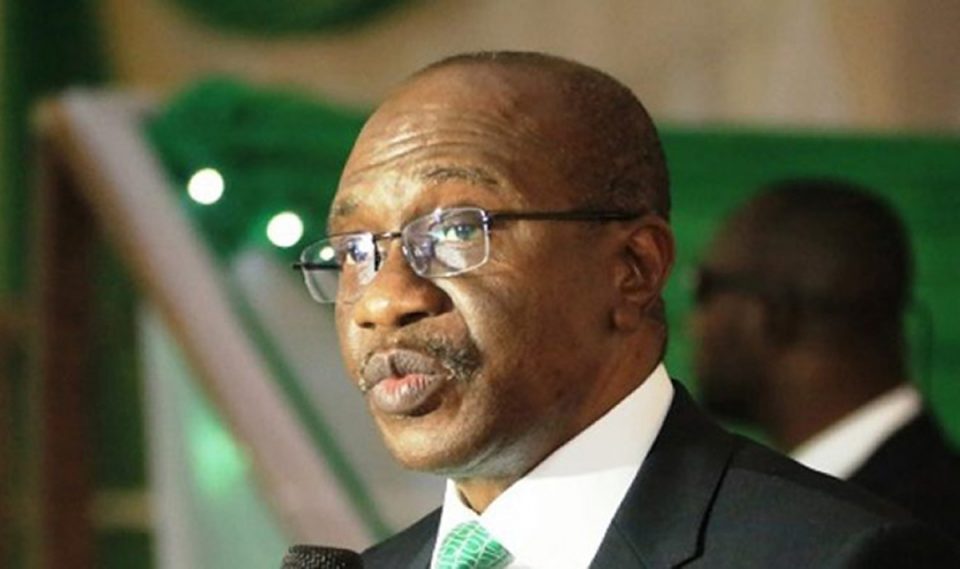

Meanwhile, Governor of the Central Bank of Nigeria (CBN, Mr Godwin Emefiele again failed to appear before the House of Representatives yesterday to brief them on the new cash withdrawal limit set by the apex bank.

The CBN governor who initially billed to appear before the House on Thursday, December 15, failed to show up, citing official engagement outside the country with the President as an excuse.

However, the House directed the Clerk to the House to write another letter inviting the CBN Governor to brief the House on Tuesday on the cash withdrawal policy, the redesign of the naira.

However, at plenary on Tuesday, Speaker of the House, Rep. Femi Gbajabiamila announced that the CBN had written to inform the House of the inability of Emiefele to honour the invitation because of his engagement outside the country

He however promised to contact the House immediately he returned to the country from his official assignment.

The House however resolved to reinvite the CBN governor to appear to brief the House unfailingly by 10am on Thursday, December 22, 2022.

The Speaker however ruled that if, for any reason, the CBN Governor is still not back to the country, he should designate any of his deputies that is conversant with the issues to brief the House.

The Speaker said the CBN Governor owe the parliament the responsibility to brief them on the policies of the bank in accordance with that provisions of the CBN act.

President Muhammadu Buhari also met with Gbajabiamila yesterday to discuss various national issues, including next year’s general elections, associated rising violence and the controversies trailing recently introduced cashless policy.

Gbajabiamila, who disclosed this to journalists after the meeting held in the President’s office at the Presidential Villa, Abuja, also disclosed that the 2023 Budget is expected to be passed into law by the National Assembly on Thursday, barring any last minute changes.

The Speaker also dissociated the House of Representatives from recent N89.01 trillion controversy being steered by a member of the House of Representatives, Hon Gudaji Kazaure, saying it had nothing to the Lower Chambers of the National Assembly and that unless the member’s actions attempts to impugn on the integrity of the House.

Asked what he visited the President about, Gbajabiamila said his visit was routine, adding that they had discussions on critical national issues, which included issues around the Central Bank of Nigeria’s (CBN) recent cashless policy and the rising political violence in different parts of the country.

Asked to elaborate on his meeting with the President, he said “things that come up in the last few weeks, things come up every day in Nigeria, every day and in the last few days, some things have come up. I’m sure you know some of these things, and I just wanted to get his perspective on them and give him mine and that of the National Assembly’s perspective and position on those matters and we had a fruitful discussion.

“Well, I wasn’t actually intending to talk to the press. It was just a discussion between the President and I, but of course, there were issues around cashless policy, issues around elections and the violence that seem to be to be erupting here and there, and a couple of other very important matters as well”, he said.

The World Bank has warned that the timing and short transition period of the naira redesign policy may have negative impacts on economic activity.

The international financial organisation issued the warning in its latest Nigeria development update (NDU) report titled ‘Nigeria’s choice‘.

Commenting on the monetary policy, the World Bank, in its report, said the phasing out of existing naira notes over a short time period may add to the challenges of poor households and small-scale businesses.

“While periodic currency redesigns are normal internationally and the naira does appear to be due for it, since naira notes have not been redesigned for two decades, the timing of and short transition period for this demonetisation may have negative impacts on economic activity, in particular for the poorest households.

“International experience suggests that rapid demonetisations can generate significant short-term costs, with small-scale businesses, and poor and vulnerable households, potentially being particularly affected due to being liquidity-constrained and heavily reliant on day-to-day cash transactions.

“At present, households and firms already face elevated financial pressures from prolonged, high inflation, recently compounded by external food and fuel price shocks, and the severe floods, and phasing out existing naira notes over a short time period may add to their challenges,” the World Bank stated.