NDDC repositions, eyes best corporate governance, expanded revenue sources

*Mulls sustainable Niger Delta development

*In talks with KPMC, PwC, others

By Emeka Ugwuanyi, Houston Texas

The current management of the Niger Delta Development Commission (NDDC) is repositioning operations of the Commission to global standards and best practices with corporate governance in place as well as expanded sources of revenue generation.

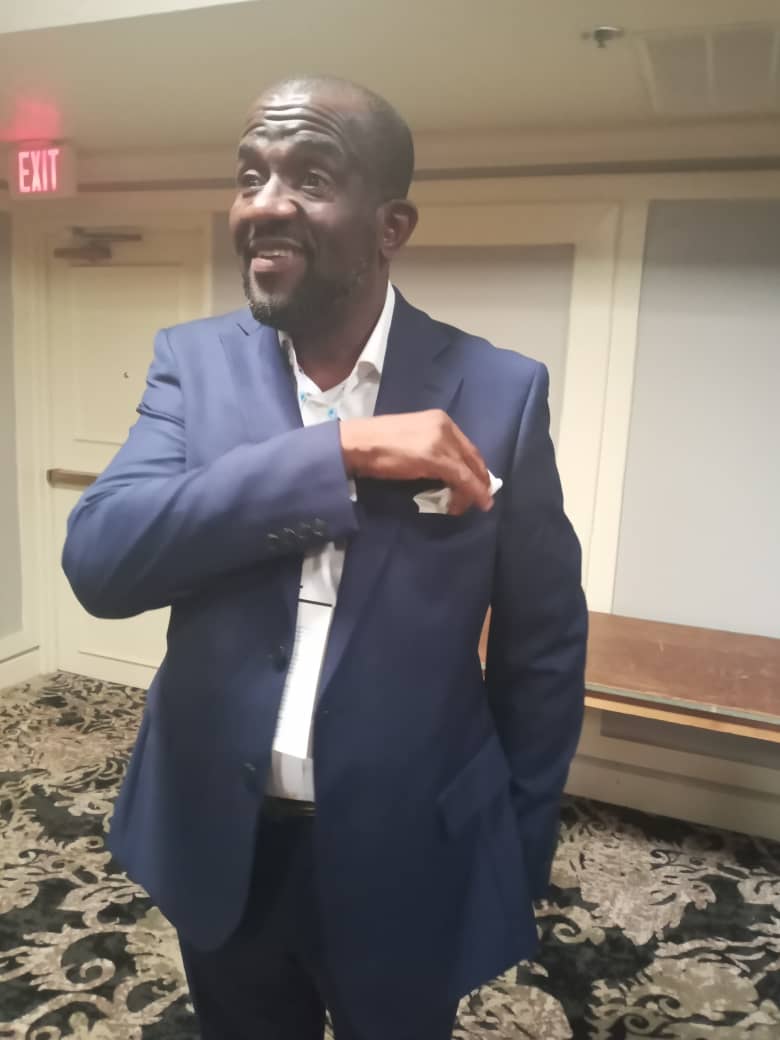

The Commission’s Executive Director, Projects, Mr. Charles Ogunmola, disclosed this in an interview with energy editors after the organisation’s investment summit held on the sideline of the Offshore Technology Conference (OTC) in Houston, tagged “Niger Delta Invest: Beyond Oil.” The summit attracted prospective foreign investors and Nigerians in diaspora who asked several questions and showed intent to invest.

According to Ogunmola, the transformation of the operations of the NDDC has become imperative in view of the huge opportunities and investment potentials in the oil rich Niger Delta region. He assured that by the time the objectives of the ongoing transformation are achieved, the region will not have cause to lack or be in need. However, corporate governance has to be in place and adhered to, in order to attract the necessary partnerships, investments and developments.

Currently, the Commission is in talks with globally renowned auditing firms such as KPMG, PricewaterhouseCoopers and Deloitte and when the deal is sealed, the winner company will establish the Commission’s corporate governance structures, among others. The deal is expected to be sealed within the next 30 to 60 days, he added.

Ogunmola said: “When we came on board on January 4. 2023, our first step was to take a critical review of what we have, what the potential and what the future will be for the Commission under our leadership. Therefore, the most prudent thing to do was that we took stock, and one thing we clearly identified was that we were not structured for success and her (NDDC’s) potential for income in the longer term and not the short term, could be highly threatened by world trends – which is renewable energy drive and which is part of the reason the oil companies have been leaving Nigeria because of the constraints they had in onshore operations and shallow water.

“So, we made a quick decision that we really need to guarantee our revenues for the next 25 years. How do we guarantee our income? If we will intervene in the Niger Delta region, how do we ensure the foundation of the intervention will remain either stable or will increase. We cannot decrease because at the moment we are behind the car on our development. So, what we decided is we read through what we have, which is the Act that established the Commission, to find out whether there is a possibility for us to ride any other sources of income, and as God would have it, there is.

“Part of the Act says we can explore other options of income as long as it fits within the Act and it is legal. So, we decided to leverage that. We have had a public, private partnership (PPP) department, in the last five years, in NDDC but it was an exploratory department. So, we decided to evolve the department into a committee and a fully forward-looking unit to start exploring ways and means to partner with others to increase our footprint.

“For example, if I have a budget of N500 billion but that budget couldn’t take me far in terms of development, firstly I can take that budget’s N300 billion and pledge it as collateral to attract loans. Secondly, if I want to build a road of N10 billion but a company or even an individual also has interest in the road, you the company or individual brings N5 billion and I bring N5 billion, we build the road and put a toll gate and share the revenue.

“We also have ways and means. The Niger Delta unknown to a lot of people is one of the most heavily degraded environments around the world. Donor agencies and development agencies and quite a lot of ecological agencies around the world have a strong focus on our region – the Niger Delta. Its degraded waterways, its ecological, its botany, environment, in fact, everything has been degraded.

“Our global partners always look at ways and means they can help others to regenerate, to clean and to have a better life for people that live in the region. So, we understand that there are funds out there in the global realm for development of that region. But we haven’t been able to access them because we have been focused on looking at the money coming in and spending it all without exploring other sources. So, we are now saying, if you have funds, please come and also spend it here and we will partner with you and guarantee the funds will be used judiciously.

“Those are some of the hard decisions we determined to pursue as an alternate Income agenda and the PPP will encapsulate everything under the banner of PPP and we said it will be side by with our traditional mode of operation in terms of sources of funds. So, as we run an agenda of generating income, it should run side by side, so at a particular point in time, as the income from the traditional sources start to increase, ours should increase too. So, there should never be at a point where the Niger Delta is ever in lack or in need. That gives us greater probity because doing these things forces us to be more transparent in our dealings, forces us to have a greater foundation of integrity. So, what we have done is that we have gone out to look for global wealth leaders to come and establish corporate governance.

“We are currently in touch with KPMC, PwC and Deloitte for one of them to come in to establish our corporate governance structures. Due process, corporate governance, everything will be world class and we will be able to operate like any professional organization anywhere in the world so that everything is done with probity and guided with best in practice rules of governance.

“We are in talks with one of them at the moment and we hope to establish an MoU with them within the next 30 to 60 days. We should be able to start that journey of corporate governance renewal.

We are also opening up ourselves to the public, and ready to partner. We have cash coming in to us and we can use our cash as collateral or for partnership or if you have cash for us, we will guarantee your safety and guarantee your funds will be used judiciously. If you are a donor agency or development agency, come. You can choose development of any of these – waterways, solar, platform ways, maternal health, among others. The region needs development.

“We have been able to do a lot more with the little we have and as we go forward, we can guarantee that we sustain our level of income for our development. That is the goal.”