*Sale of NNPCL’s major stakes in the industry to earn $17bn

By Emeka Ugwuanyi

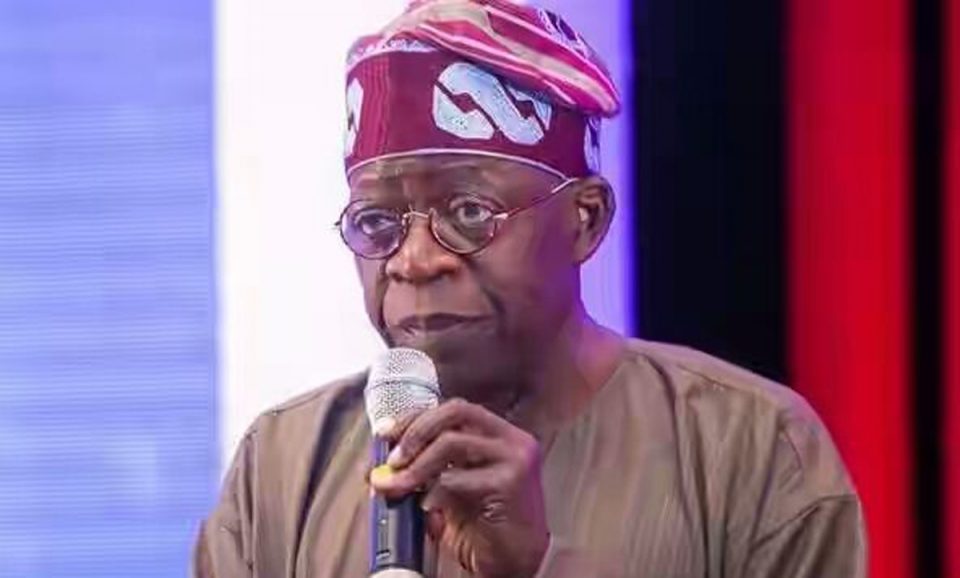

The Policy Advisory Council set up by President Bola Ahmed Tinubu has recommended merger of all the regulatory agencies in the Nigerian oil and gas industry – the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and the Nigerian Content Development and Monitoring Board (NCDMB).

The Council recommended that Tinubu’s administration consolidates the regulatory agencies by merging the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and the Nigerian Content Development and Monitoring Board (NCDMB) under a single regulator.

It also proposed to Tinubu to sell major stakes of the NNPC in the upstream, midstream and downstream sectors of the oil and gas industry, noting that the federal government will earn about $17 billion from the sale of the NNPC’s majority stakes in the oil and gas assets.

Other recommendations include that the government should work towards achieving some milestones within the first 100 days in office ending August 2023. The council advised Tinubu’s administration to re-organise NUPRC and NMDPRA to deliver set milestone goals, and headhunt and place capable resources in critical positions in the oil and gas sector.

It advised the President to head-hunt competent, tested, reform-focused leaders in NNPCL and ensure the company discharges its function as a commercial entity as stipulated in the Petroleum Industry Act (PIA).

The Council advised that NNPC should also be strengthened and placed in a position where it would be paying taxes, royalties and profits to the Federation Account and properly regulated by NUPRC, NMDPRA and NCDMB.

The council equally proposed the deregulation of petrol pricing and implementing the Federal Direct Cash Transfer Programme, with the disbursement of $8 billion in Direct Cash Transfer to the poorest 30 million Nigerians.

It advised the President to end insecurity in oil-producing states, particularly in Imo, Delta, Ondo, Rivers, Bayelsa and Akwa-Ibom by engaging key political and community stakeholders.

The Council called for the reforming of the operations of the military task force with clearly defined key performance indicators (KPIs) and consequent management to tackle deficiencies.

To improve financing in the oil and gas sector, the council called for a debt repayment framework and a transition to market prices for gas. It stressed the need for Tinubu’s government to put robust policies in place in order to unlock Nigeria’s energy potential to fuel economic growth and diversification while improving energy security sustainably.

It proposed that the government should work to raise Nigeria’s oil and gas production to 1.8 million barrels per day (mbpd) and 3.5 billion cubic feet (bcf) in the next 18 months ending December 2024.

The Council urged President Tinubu to mandate NNPCL, NUPRC and NMDPRA to close out outstanding divestments and contract issues for project delivery clarity, while further urging the president to strip NNPCL of policy-making roles and keep NCDMB within its mandate as prescribed by the Local Content Act.

The council advised the president to consider integrating NUPRC, NMDPRA, and NCDMB into a single regulator or include all midstream activities into NUPRC’s scope.

Members of the Policy Advisory Council include Austin Avuru, Olu Verheijen, AbdulRasaq Isa, Bashir Bello, Ifeanyi Ajuluchukwu, Doyin Akinyanju, Tinuade Sande, Ahmad Zakari, George Etomi, Nasiru Wada, Mohammed Abbas, and Segun Lawson.

previous post