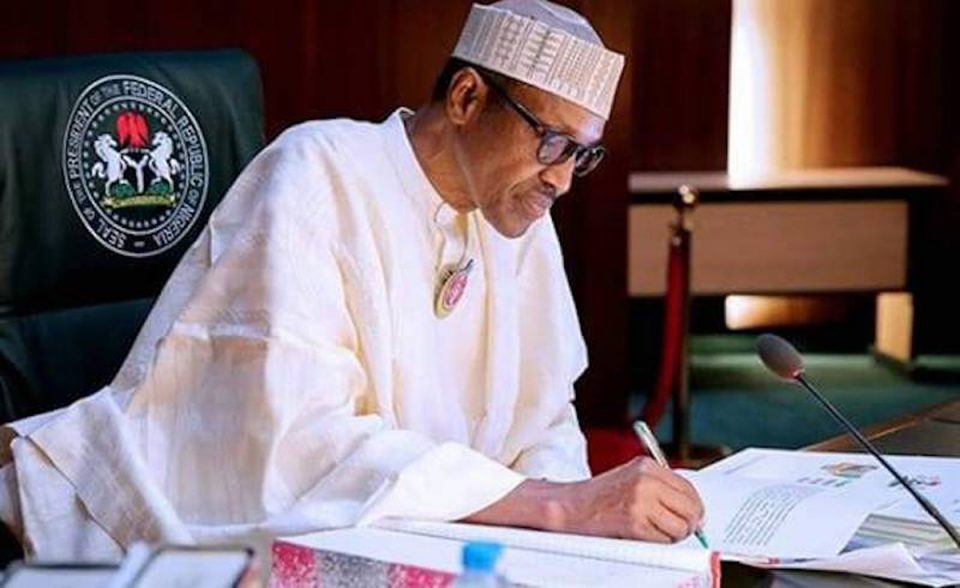

Just 48 hours after President Muhammadu Buhari signed his administration’s towering, flagship Petroleum Industry Bill (PIB) 2021 into law (now the Petroleum Industry Act, PIA), on August 16, following its passage by the National Assembly, shadowy forces have gone to work to instigate crisis, smear and impugn the integrity of the nation’s energy sector managers.

PIA provides a comprehensive legal, governance, regulatory and fiscal framework framework for Nigeria’s petroleum industry, the development of host communities and an impressive swathe of other related matters. President Buhari immediately appointed Timipre Silva, Minister of State, Ministry of Petroleum Resources, to head the implementation steering committee.

Perhaps, the transformational implications of that bold, visionary executive action may have given spoilers the jitters and activated a serious, blackmail-tinted plot to create suspicion, distrust and disruption within the ranks of the key agencies that currently manage that strategic sector.

On August 18, an article in THISDAY Newspaper, authored by a certain Jones Edwin, without a specific affiliation, purporting to write from Houston, Texas, US, made two specific allegations against NAPIMS.

NAPIMS – the National Petroleum Investment Management Services is a Corporate Services Unit (CSU) in the Exploration and Production (E&P) Directorate of the Nigerian National Petroleum Corporation (NNPC) charged with the responsibility of managing Nigeria government’s investment in the upstream sector of the oil and gas industry.

The publication basically ascribed the author’s alleged retardation of deepwater projects in Nigeria to the leadership of NAPIMS and by extension NNPC, hence, the loss of opportunity to attract FDI of about $75 billion to Nigeria. It also curiously alleged the contractual engagement of Messrs. Contraco as an agent of NAPIMS for the lease of 10 flats at 27b Queen’s drive, Oyinkan Abayomi close, Ikoyi, Lagos.

What is deducible is that certain interests are better served by the old subjective processes and order.

But it is crystal clear that adopting best practices in industry operations serves the overall interest of Nigeria and the NNPC, far better.

On Friday, August 20, this same spurious, page-length balderdash titled, “How NNPC’s NAPIMS Contributed To Nigeria’s Losses In $75bn Foreign Direct Investment,” was also published in the LEADERSHIP Newspapes.

Some dislodged demons were clearly on the war path.

The shadowy author cleverly credited the source of his tale to oil professionals who attended the just concluded Offshore Technology Conference in Houston, Texas. But then it is on record that all senior industry management including the MDs of the IOCs were in Abuja, meeting to resolve some of the protracted issues affecting the industry. This scenario specifically exposes the false tattle tales of the author.

From the content of the publications, it was also immediately apparent that the hatchet writer lacked proper knowledge of the workings and processes of upstream operations and investment – the highly specialised industry niche he was hired to sow disruption in. A cursory fact-check quickly establishes that his claims were not only false, malicious but patently unfounded.

For one, investment in the upstream oil and gas sector requires certain key fundamentals to be met. Topping the list here are fiscal regime certainty, contractual terms clarity and enabling business environment. The upstream business, specifically deepwater project development requires heavy upfront capital investments running into billions of dollars and usually with lengthy pay-back period. The complex nature of the projects and sophisticated extraction technology deployment make this an imperative.

Secondly, the operational uncertainty placed in the market by the protracted development of the PIA (PIB then) since the year 2000 had stalled investments in Nigeria and slowed down project developments. International Oil Companies (IOCs) had already paused projects like Bosi, Bolia-Chota/Nnwa-Doro, Bonga North et cetera while awaiting the new PIA and its accompanying fiscal terms.

Thirdly, the Deep Offshore and Inland Basin Production Sharing Contract (PSC) (Amendment) Act, 2019 significantly changed the fiscal terms under which most of Nigeria’s offshore blocks were assigned and PSCs executed. The Act was a significant change in outlook for the investing IOCs and its implementation conveyed a significant change to the assumptions they had made in placing investments into Nigeria at the detriment of similar opportunities elsewhere.

Subsequently, IOCs deferred the long-delayed projects and sought the renegotiation of the PSCs (stabilization clauses) in some cases. For instance, some of the partners officially notified NNPC of the suspension of projects like Owowo Project,and suspension of works on the FPSO Firenze which was to be used in the Abo field redevelopment, and all discussions on Bolia-Chota/Nnwa-Doro stalled completely.

More, while this market uncertainty persevered in Nigeria, COVID-19 morphed into a global pandemic in early 2020 and the global response triggered severe constriction of energy demand. This spawned extreme pressures both on IOC balance sheets and on external funding for oil & gas projects. Fitch’s Oil & Gas Global CAPEX report 2021 suggests that Global Oil & Gas Capital expenditure shrunk 25% in 2020 for IOCs and 48% for independents.

Consequently, several projects were put on hold, not only in Nigeria, but globally, while energy companies with weak balance sheets went under and several have not recovered. In this fluid environment, with IOCs struggling for survival, no projects could be started in Nigeria.

It was perhaps providential for Nigeria that NLNG had taken a Final Investment Decision (FID) in December 2019 as this would surely have been delayed if that decision was deferred to early 2020.

It was during this uncertain and turbulent business climate that Mr. Bala Wunti assumed duty as GGM NAPIMS, in March 2020. In sync with the new leadership of NNPC ably led by Mallam Mele Kyari, the immediate task was not to secure project funding that was globally unavailable at that time but to ensure that NNPC itself survived as a viable entity.

Having successfully navigated the worst period and with global energy demand recovering, the new challenge is the changing energy demand patterns fueled by energy transition trends (Decarbonization). It is indisputable that securing long-term financing for oil projects is getting more and more challenging today. But significantly, under adroit guidance of the GMD NNPC Kyari, NAPIMS has managed to secure progress on major capital projects in the deepwater even before passage of the Petroleum Industry Act (PIA).

Some of the notable positives include kick-starting the Owowo Project Development activities evidenced by resumption of Field Development Planning activities. NAPIMS has also secured the early renewal of OML 118 PSC/lease and restarted the Bonga North Project activities and BONGA Southwest/ Aparo Project (BSWAP) with other deepwater partners pursuing renewal of their PSCs/leases to enable them resume project activities.

Of crucial importance here is that President Buhari’s assent to the PIA has gone a long way in incentivizing the market appetite for oil projects. IOC’s restarting projects before the passage of the PIB and lease renewals is attributable to the personal interventions and hard work of NNPC Management, under Mele Kyari and NAPIMS, in the face of very challenging market indices.

However, circumspect industry observers note that Mr. Wunti, both in his past role as the Chief Strategist of the corporation and GGM NAPIMS and the current GMD, have worked assiduously to resolve a lot of protracted disputes that lingered for so long.

These include the settlement of OML 118 dispute which was described as a ‘watershed moment’ by all the IOC parties in the dispute’s paves way for the unlocking of over 1bn of oil in the block, up to 1 TCF of gas, unprecedented partner alignment, foreign direct Investment inflow of almost $10 billion, contract lifecycle revenue of over $50 billion that will create energy security and shared benefits for both the investor and nation.

Then there is the settlement of OML 130 dispute production which unlocks gas revenue to the tune of about US$225mn in the short term, and US$510mn in the long run. Further, the OML 143 deal which is the first agreement in Nigeria that fully separates gas development from oil production that unlocks 1.2 trillion cubic feet of gas for power generation and domestic industries with a potential impact of over $600m.

With these huge accomplishments that happened in the midst of COVID-19, the fortunes of Nigeria’s upstream sector – in particular the deepwater terrain – clearly would never be the same again. Against this background the hatchet writer’s allegation, or reference to ‘fleeing investors’ becomes even more curious and improbable.

It is noteworthy to recall that on Mr. Wunti’s resumption in March 2020, one of the priority tasks he took was the emplacement of a robust business continuity plan that ensured strong collaboration with industry players to guarantee seamless oil production and national energy security throughout the period.

During the period, Mr. Wunti’s prominent support to the NNPC GMD, to rally upstream players to deploy one of the most successful COVID-19 intervention programmes in the country cannot be easily forgotten. Medical consumables, logistics facilities, temporary and permanent healthcare facilities, worth over N21bn, were deployed across the nation.

Going forward, the two other fallacious allegations by the paid hack are on the so-called appointment of CONTRACO NIGERIA LIMITED by NAPIMS to lease10 flats at 27b Queens Drive, Oyinkan Abayomi Close, Ikoyi, Lagos and stalling of deepwater projects by NAPIMS leadership.

A simple fact-check will disclose that NAPIMS does not have any agency contract with Contraco Limited on the lease of 10 flats at 27b Queens Drive, Oyinkan Abayomi Close, Ikoyi, Lagos as alleged by the publication.

NAPIMS does not have any contract with the company. For the records, Messrs. Contraco Limited submitted a proposal for sale of a property on 22 Thompson Avenue, Ikoyi to NIPEX (a division of NAPIMS) on June 18, 2021, and this offer was never considered by NAPIMS as it was not part of the procurement plan of the organization.

On the alleged stalling of deepwater projects by NAPIMS leadership, this is neither substantiated nor supported by facts. Some of the deepwater projects which are the subject of deliberate misinformation include – PREOWEI Project (PRP), BONGA Southwest/ Aparo Project (BSWAP), BONGA North Project (BNP), OWOWO Project (OWP) and NSIKO Project (NSP). The facts concerning development of some of the deepwater projects referenced in the article speak for themselves.

PREOWEI Project (PRP): PREOWEI development, conceived as a tie-back concept to the EGINA FPSO. PREOWEI was on fast-track to achieve FID in Q4 2019, but the contractor suspended all activities following the passage of the Deep Offshore Inland Basin PSC (Amendment) Act in December 2019, citing business impacts due to the passage of the amendment. This was prior to resumption of the current leadership of NAPIMS in March 2020. However, NAPIMS has worked with industry partners to ensure that a steady production state is achieved on EGINA.

BONGA Southwest/ Aparo Project (BSWAP): The BSWA project was conceived following the commissioning of BONGA Main in 2005. The objective of the project is to develop 3.2 billion barrels of oil. This development opportunity has gone through 2 previous unsuccessful cycles of tenders starting 2007. This highlights the complexity of balancing commercial, technical and regulatory considerations required for Upstream capital investments/Projects.

BONGA North Project (BNP): This development opportunity has suffered series of reframing as standalone as well as tie-back to the existing BONGA FPSO for over a decade. NAPIMS is driving several initiatives that will accelerate the project execution. These include the empowerment of the Joint (NAPIMS/ Operator) Working Group concept and deployment of resources and processes to support the unique tendering environment.

OWOWO Project (OWP): NAPIMS worked on the NAPIMS/ DPR/ Operator JWG to conclude the OWOWO Field (OMLs 139/ 154) Unitization agreement within a record 3-months timeline. The development was on course to achieve a First Oil within 36-months from a Q4 2021 FID. But NAPIMS’ partners suspended all activities following the passage of the DOIBPSC (Amendment) Act in 2019, directly citing the impact of the Act on their investment models.

NSIKO Project (NSP): The available oil and gas resources in NSIKO and neighboring UGE Field makes standalone developments uneconomical considering development costs profiles in deepwater. NAPIMS in a bid to resolve technical challenges facing the development proposed a Joint Development Concept between NSIKO and UGE development opportunities.

One thing is clear, the NNPC, NAPIMS and federal government at large must be on their guard as even more disruptive attacks by corrupt, frustrated forces of regression go on further offensives.

- Ukpe, a co-convener of Initiative for Peaceful Nigeria, writes from Akwa Ibom.