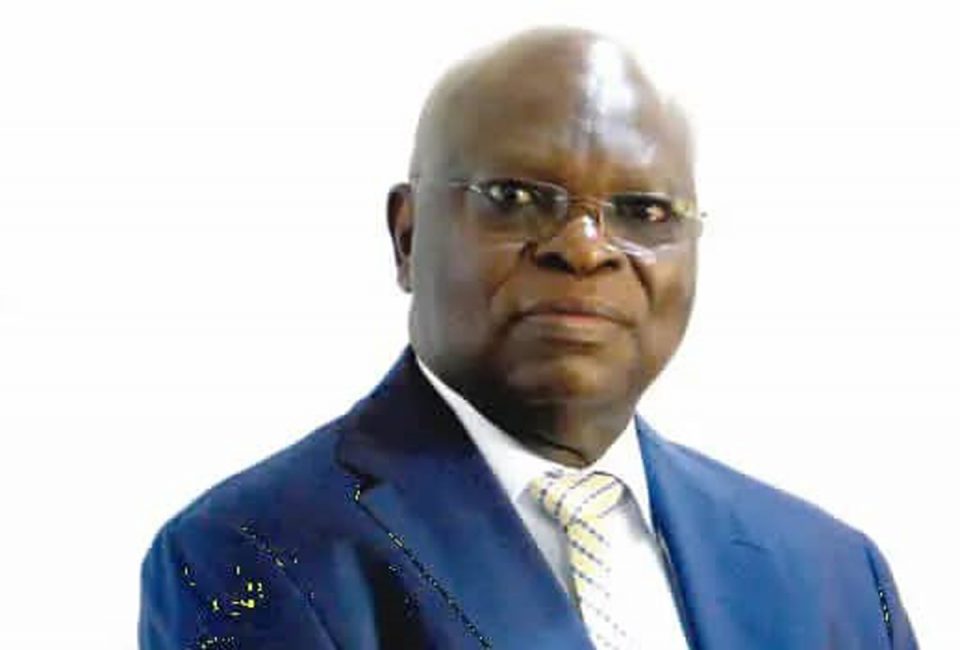

The outgoing Chairman, Odua Investment Company Limited, Dr. Segun Aina in this interview shared some of his achievements as he exchanged baton to usher in a new administration to govern the Odua Group. According to him, its Sweat, Revive and Create 2025 strategy aimed at repositioning the entire group is right on course. Gilbert presents the excerpts

What were your expectations on assumption of office as Chairman, Odua Investment Company Limited and will you say these expectations have been met?

Thank you very much for this opportunity and the question you have asked. Let me start from where I was informed that I was nominated to be the Chairman of the Odua Investment Limited and prior to that I have always known about Odua, and I was told that the reason why they are bringing me and my colleagues on board was to revive the company, transform it and make it a company to reckoned with and competing with other companies that are in the same line of business. So, with that said, I knew the first thing that we needed to do to transform the company from the position it was at that time to a company that we will all be proud of. I knew it was going to be really hard and I had to devote a lot of time and attention to leading the board in achieving the kind of mandate that we were given when we were appointed. The former board was dissolved based on certain issues and for about a month, the company did not have a board until we came in, so there was nobody to hand over to us. Right there, I knew it was going to be hard work, but I knew that it is human beings that bring about changes, especially when you are determined and when you believe that you are working with a group of people who share a common vision. The State Governors have done well by making sure that they bring people with common purpose, because it would have not been easy and my expectation was that I knew it would be hard work but looking at the profile of the people coming together, I had a sense of relief that we will deliver. The new Chairman is somebody I have known for so many years both professionally and socially, so it was easy for all of us to work as a family even though we are representing different shareholders, even though we have different ideas, but we all have a common purpose, which is the growth and development of this company and because we see it as an opportunity and a great privilege to be invited to serve on the board and for me to serve as the Chairman was a great privilege and we did our best. So in terms of expectation, we knew that it was hard work and also knew that it was possible and with the people we had on the ground in support of the management, we were able to move the company from where we met it about a few years ago, to a level where people are now hearing a lot of good things in Odua. We have laid a very solid foundation and we can now compete with the best of the companies in the various fields that we are working and in terms of expectations like you said, I am happy that we have met our expectations for the three-year period. Where we are now is the next step to move forward and it is a good time for a change in chairmanship so that we can start from where we are and it is a succession and a continuity of people that have worked together. We have designed for ourselves a five-year plan, so this three years that I have served is just part of that five year plan so we have loaded expectations for the remaining years and with Ashiru and his Board, definitely they would get to that level and we believe that by 2025 when we look at the situation of the company, it is going to be a situation that we have set for ourselves in 2020 and by the grace of God, the level would be surpassed.

How were you able to surmount the challenges you encountered and what are some of the achievement recorded by your administration?

Odua Investment is a company with significant public interest given the fact that the government of the South West States owns it. When you say government, we are all part of the State, so that means Odua is owned by everybody in the six South-West States, so you would expect significant public interest and what that means is that there will be divergent views, there will be different views about how this company should be and different opinions unlike a private company, but Odua is different because it is owned by everybody within those six States and they have the right to talk about Odua and what they expect. So, whoever is leading the company will be somebody that can know how to balance divergent views and will also have to know how to navigate the various interest groups, because the various interest groups actually exist and you have to take care of them by opening up to them. We must be able carry them along on what we are doing and for the State Governors because they actually have also a clear mind as to where they want to take this company to, which influenced the decision to appoint the board that they appointed, they were there at all times to give us support and they were there all times to share in our pains, they were there when we had issues with the federal government in terms of the oil license that we received. We went to them and said we have gotten the allocation, but the allocation is not what we wanted that we wanted something bigger. They were able to rally round and got our issues resolved, so that shows their interest, that showed their commitment, readiness and their believe in us and that is why today you see all the governors especially the chairman of the Southern Governors’ forum were all here and this is not how the Odua Annual General Meeting (AGM) is normally done. They decided on their own that they wanted to be here personally to witness the AGM and the change over and that gives us a lot of confidence that they are with us and it gives us lots of confidence that they believe in what we are doing. So in summary, we understand the environment that we operate and we carry everyone along and that is why we have not had any negative publicity apart from all the usual issues, but we have not had any major controversy on the board. We are not politicians to say that this is a political appointment, so I need to make all the money I can make or to say I need to bring people from my constituency to work here in Odua. This is an assignment that we have been given and we are going to do it to the best of our abilities, we are not interfering with management because they have their own role so also the board. There was an office for the Chairman in the Cocoa house, but he, “said why will he go to the Cocoa house when I have his own business,” so we had to close that office to give it to staff for use. That shows that we are not interested in management of that company. Our own is to set the goals and strategies and monitor how they are implementing and support them and that is why we have seen the kind of growth and the kind of progress that we have seen in the past three years, there has been support from the state governments.

Do you think that what has happened in Odua supports the concept of government having no business doing business and does your achievement recorded over the years justifies the existence of Odua Group?

On the first issue, when you say government has no business doing business, what it means is that government should not be running businesses, it does not mean that the government should not invest in the business. Governments buys shares in companies on the stock exchange, but they are not running it, they believe in that business and this is not different from Odua. That is what has brought the fundamental change unlike before when government was much more involved in the way Odua. That they are involved does not mean that they are there on a day to day basis. Starting from the kind of people on the board and how detached are they from politics and judging from the internal structure that are put in place you can see the difference. That is why the first thing we did when we came on board was to spend a lot of time working with the KPMG global consulting firm to design for us what should be new corporate governance structure, what should be the guideline that we must follow that successful businesses, not only in Nigeria are following and that was what they brought to us. The board approved it and we took it to shareholders and they approved everything that we took to them. Another notable change we have today is that when somebody is appointed to the board for a term of four years, you cant remove that person except the person is not performing. This is unlike in the past where if the government changed hands and a new governor comes in or a new party, they remove the director representing the state, but that cannot happen anymore because the new shareholder agreement that has been signed by the State governments says once somebody is appointed to the board, he serves his terms and it is the board themselves based on best practice that will evaluate the person in office. So every year we put in place a governance review to look at how we are performing, to check how many meetings we have attended and the contributions we made. So, the success of the company is in our hands and we are held accountable. We do not have any excuse to say we were not given a free hand. That concept is applicable to when government themselves invest in a company or set up a company, appoint the Managing Director, but the government do not ask who is the Managing Director of Odua, it is the board that appoints the Managing Director of Odua going forward under the new leadership and of course we also brought in independent non-executive for the first time in 40 years history of Odua, it has never happened. Those independent directors are people that are not representing any state, that brought about a lot of objectivity to the board and in terms of the way they contribute to the board because all the others are representing directors and shareholders and of course when you are representing a shareholder, you must always look at the interest of the shareholders, but when you have independent directors who are not representing anyone and not accountable to anyone, but themselves you have an effective board. The independent directors were appointed through head haunting by KPMG and they brought a lot of them to us. So these are all the structures that we put together that made the company run as a business and not as an appendage of government and to react to your second question, I will say if you look at where we are as an institution, I will say that the performance we have seen today is not where Odua should be. We should be far ahead of where we are today, but this should not take away the contributions of those who have served on the board in the past. For the fact that Odua is still existing is something we should be happy and proud about. There are other similar organisations in the country, I do not know if they are existing, but I have not been hearing of them, so Odua is still existing today and it shows the resilience and contribution of people in the past. We are not happy with just existing; we want to be the best in all the areas that we operate. We want to make Odua, the engine room for economic development for the South West region and by extension, Nigeria and that is the vision we have and the programmes that we have for the past two years to move it forward and to run like a commercial entity that it is. I believe that despite a lot of years that have gone, if this trajectory can continue the next five to 10 years we will all be happy and be proud of the company that we have all been part of. To answer your question, we are not happy and Odua should not be where it is today. We have been able to prove in the last few years that this company has a potential with all the array of resources we have, we have the potential to be able to do more. We see the future as that of growth and development particularly in the South West region.

Odua obviously has diverse interests in various sectors of the economy and out of all these interests, which one would you say is its weakest link? What exactly are you doing to fix this?

Yes, that is a good question. We are into various sectors. We are into real estates, hospitality, printing, insurance, we also have some interest in Wema Bank. Some of our companies have not been performing at a level we want, some are doing extremely well while some are not doing well and I am happy to report that Wema bank for instance in the last two years, have had tremendous results in whatever they are doing. We are not happy with what we met on ground and yes if you look at our portfolio today, our hotels are not doing as well as they should, but I will say it is a major assignment for us because we have enormous resources, we have enormous assets and we have the good will. We are turning it around, but we are not seeing it as the weak link, but we see potentials in there. We are not looking at it as a half empty glass, but a half full glass and when things are down, anything you put into it, it shows progress and development. For us at the board, we believe that all our entities have not done as well as they should have done. The associate companies where we do not have little amounts like Nigerite where we have 50 per cent and Lafarge we have 43 per cent are doing extremely well in terms of the results they are given us and we are not running it and that is why some of the policies that we have taken and approved by the governors under the new chairman will make sure that we progress, to make sure that we do not own 100 per cent in every business, because we believe that we should be an investment company. Invest, make money and if you like sell the investment and buy another one so that we keep making the money not to have 100 per cent and we are the ones running it, because we are not experts in running different businesses. We cannot be jack of all trade and masters of none, so we are saying that Odia should deliberately be looking for investors to buy shares and even if they are they are buying 70 per cent, because when you have 10 per cent of a company that is doing very well is better than having a 100 per cent that is not doing very well and that is the next policy thrust under the new Board lead by Otunba Ashiru. Talking about hospitality business for instance, we are talking to investors who have global brands to bring to the table so that we can change the face of two of our major hotels to make it the go to place when it comes to accommodation. We have also created new companies to focus on agriculture, innovation and technology while another one is focusing on oil and gas and from there we move to energy such as alternative energy sources. So what we are doing in the Odua Group is to create jobs but it does not mean that we should have 1000 staffs working for Odua, but what it means is that we should have the right number of staff in Odua that can create new entrepreneurs and employ people. This is what we are focusing on. We are partnering with existing businesses, partnering with new businesses. Supporting them so that if you have 100 companies with each employing 50 people that is already 5000 people, Odua cannot employ 5000 people. This is why we are set out to create jobs rather than get employees who are not doing anything; this is why we have a lean structure now. We get top professional who are experts in various fields so that when we are investing, we will have experts who understands that sector and see where that sector is going. We are putting our money in businesses we know would turn out well

Tell us about the SRC 2025 vision that was developed under your leadership. Do you think the new board will continue with the vision?

I have actually mentioned that earlier on. The first thing is that the strategy programme that we put together was done by everybody in this group including members of the board of some of our companies. They were there when we crafted the strategy in 2020, so we are all part of it and like I have also mentioned, board leadership is a continuum as I am leaving and handling over to someone else as the chairman, we are lucky that the person that is taking over was part of the team that developed the strategy and he believes in it 100 per cent. So definitely, he will be able to drive it in the right direction, which is different from somebody else coming in and this is what happens in many organisations, particularly in government organisations. We have this continuity where a chairman appointed within existing members of the board to the extent that we all work together as one even though we disagree and that is the only sense of diversity in the Board. We listen to everyone and we put things together and by the end of the day whatever decision we come up with is acceptable to everyone. I do not have any doubts at all because SRC is on course. We have made fundamental progresses by indifferent areas. We have been able to accomplish eight things out of ten, just two lagging behind and we also have a catch up plan and by the end of the third year. We must make sure that we catch up on those areas that we are lagging behind, so I have no doubt that by 2025 and we believe in the board too, because some of the goals that we set for ourselves are goals we may even achieve before 2025 with the kind of commitment that I see and the kind of support mechanism that we have around us. We should be able to do a lot more that we have set out to do in 2025.